How To Guide Fiscal Croatia

Fiscal Overview

For shared background, see Fiscal Overview.

Croatia Fiscalisation Introduction

In Croatia, POS fiscalisation is a legal requirement for businesses to ensure accurate and transparent financial reporting.

It's important for businesses in Croatia to select a certified fiscal solution and ensure proper installation and configuration of the system to meet fiscalisation requirements. Failure to comply with POS fiscalisation regulations can result in penalties, fines, or legal consequences.

Overall, POS fiscalisation in Croatia aims to enhance transparency, combat tax evasion, and streamline the process of tax collection by leveraging electronic recording and reporting of sales transactions.

Deployment Overview

- Initiate the ‘application updater update.zip’ file first.

- Wait until it succeeds.

- Send the ‘update POS min.zip’ file.

- Wait until it succeeds.

- Send the Fiscal Module Update.

- Once it succeeds, the POS is ready with the new POS Fiscal Module.

Configuration Overview

The following configuration changes are required and must be broadcast to all Croatia devices in preparation for go live. Detailed steps for how to do this are contained in supplementary How to Guides available on the Enactor Insights portal, as well as being covered in the Introduction to Enactor training course. Although steps have been taken to ensure that the POS will not start or perform transactions without a valid configuration it is the retailers responsibility to ensure a valid configuration is present and not to try to circumnavigate any of the requirements of the Croatia Fiscal Legislation through misconfiguration of the solution.

Region

Region must be configured to continue the other configurations related to the fiscalisation.

For more detail on region creation refer to the How-To Guide Configuring an Organisation Structure

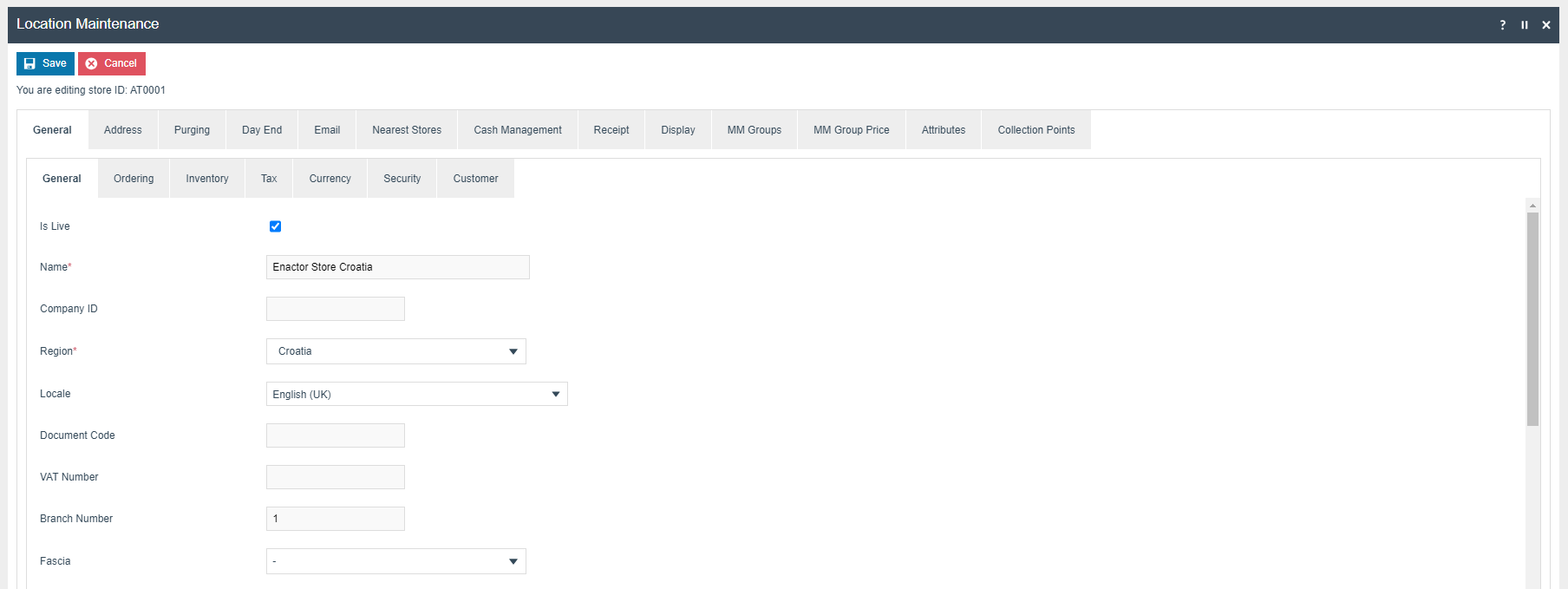

Location

| Location ID | Name | Region | Base Currency |

|---|---|---|---|

| HR0001 | Enactor Store Croatia | Croatia | Croatia Kuna |

Privileges

The following privileges will need to be configured against the appropriate roles and broadcast to the Croatia devices. Consideration should be given to whether it is desirable for all operators to have all of these privileges or if some should only be granted to managers. For more detail on Privileges and roles refer to the How-To Guide Configuring User, User Roles and User Templates

| Privilege ID | Application Package |

|---|---|

| enactor.pos.RequestSimpleFiscalInvoiceAllowed | Enactor POS |

User

| Field Description | Value | Comment |

|---|---|---|

| User Name | TESTUSER | User name of the User |

| Password | 1010 | Password of the User |

| Location | Enactor Store Croatia | General Tab, update field |

| Role | Sales Assistant - HR | Roles Tab, update field |

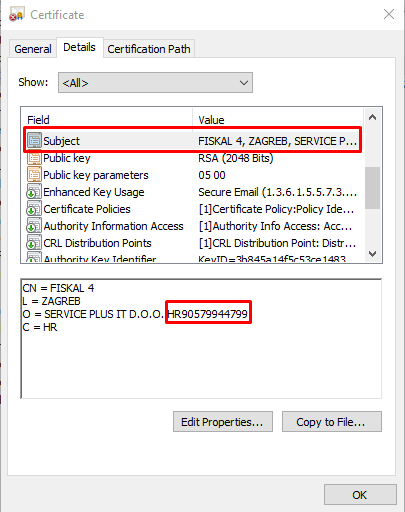

| Fiscal User Reference | OIB Operator Number | General Tab, update field |

OIB Operator Number: Retrieve this from the certificate > Subject section.

The image above represents a demo certificate details section.

Example OIB Operator Number: 90579944799.

How to request Demo Certificate:

- Go to “Business application certificate for fiscalization” site.

- Click on Request Certificate under the “Application demo certificate for fiscalization” section.

- Follow the steps in the “Issuance of Demo application certificate for fiscalization” page.

Note: Have to request a new certificate if the existing certificate is expired.

Tax Groups

The following tax groups should be configured and broadcast to the appropriate Croatia devices.

| Tax Group ID | Description |

|---|---|

| HR-A | Tax group A |

| HR-B | Tax group B |

| HR-C | Tax group C |

Tax Scheme

The following tax scheme should be configured and broadcast to the appropriate Croatia devices.

| Tax Scheme ID | Description | Price Include Tax |

|---|---|---|

| HR_VAT | HR VAT | TRUE |

Tax Rates

The following tax rates should be configured and broadcast to the appropriate Croatia devices.

| Tax Rate ID | Description | Display Code | Percentage | Fiscal Tax Rate Reference | |

|---|---|---|---|---|---|

| HR-1 | Class A | A | 25% | 1 | |

| HR-2 | Class B | B | 13% | 2 | |

| HR-3 | Class C | C | 5% | 3 |

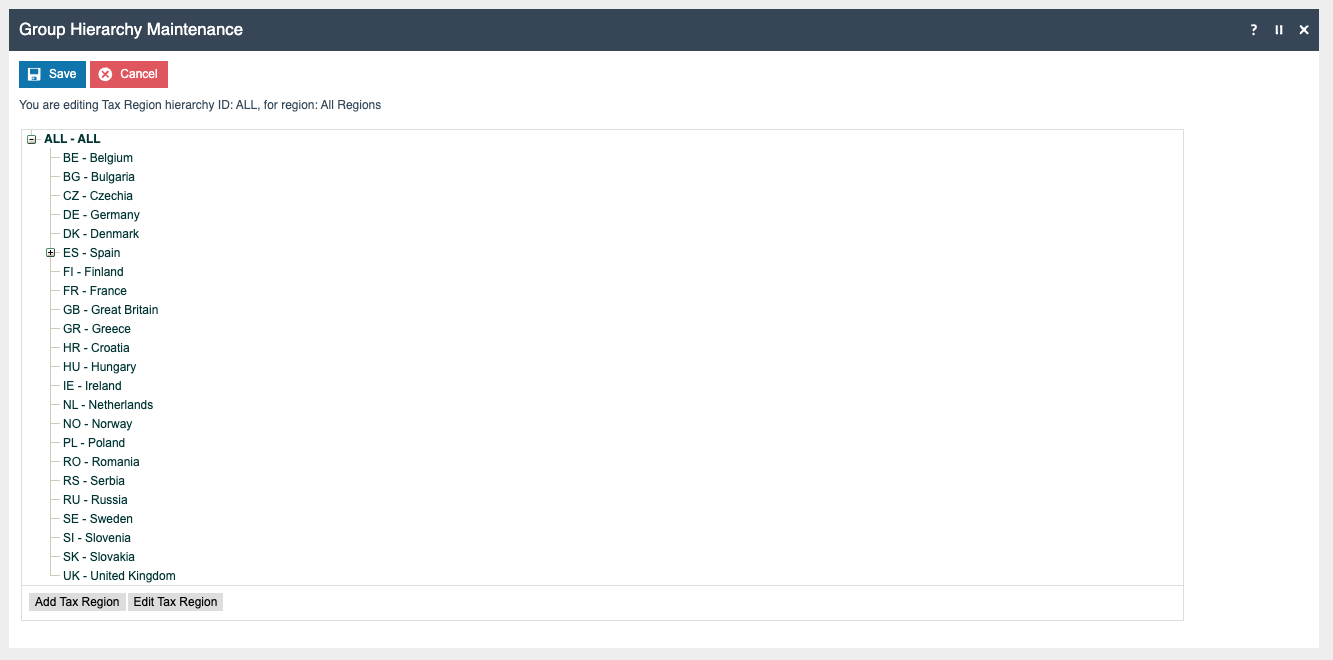

Tax Region

If it does not already exist, a Tax Region for Croatia should be created within the Tax Region Group Hierarchy. It should have the ID: “HR” and the Name: “Croatia”, and it is not necessary to configure an External Reference ID.

- Groups > Group Type = ‘Region’ > Hierarchy ID = ‘All’

Tax Group Tax Methods

The following tax group tax methods should be configured and broadcast to the appropriate Croatia devices.

| Tax Group ID | Tax Scheme ID | Description | Tax Rate |

|---|---|---|---|

| HR-A | Croatia | HR 25% | HR 25% |

| HR-B | Croatia | HR 13% | HR 13% |

| HR-C | Croatia | HR 5% | HR 5% |

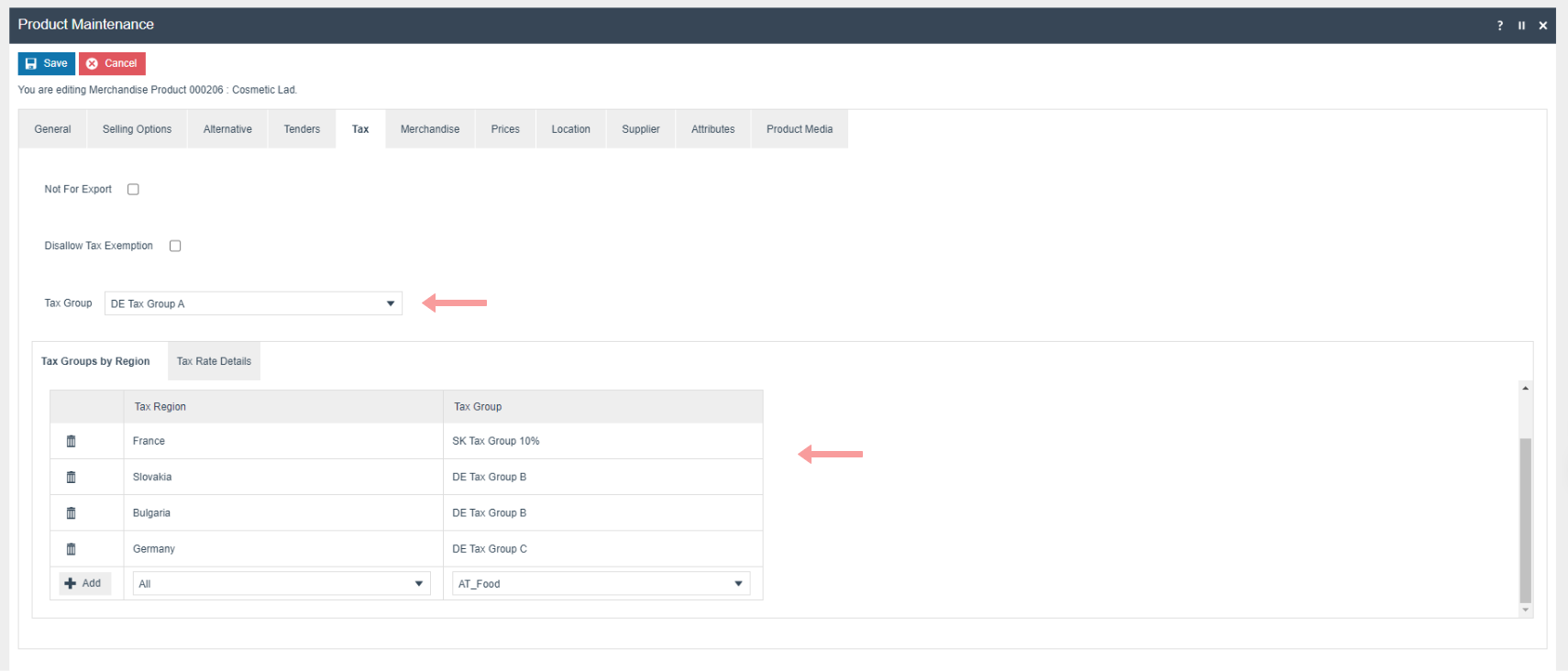

Product Tax

The following tax configurations should be configured againts the products and broadcast to the appropriate Croatia devices.Tax group can be defined to either configure the tax group or have a tax group by tax region.

Device

Devices must be created in the Croatia location to add it to the POS terminal.

For more detail on device creation refer to the How-To Guide Configuring A New Store

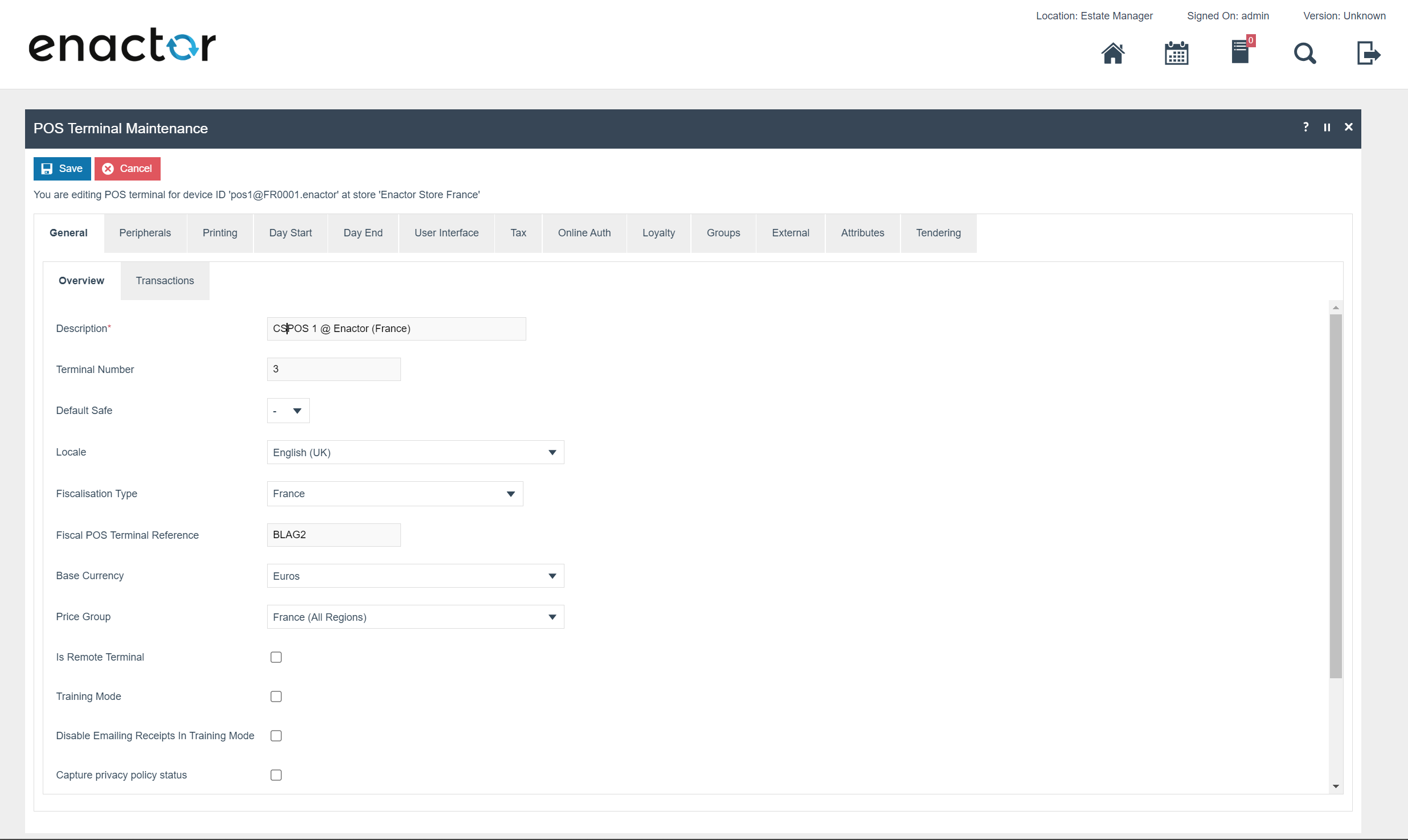

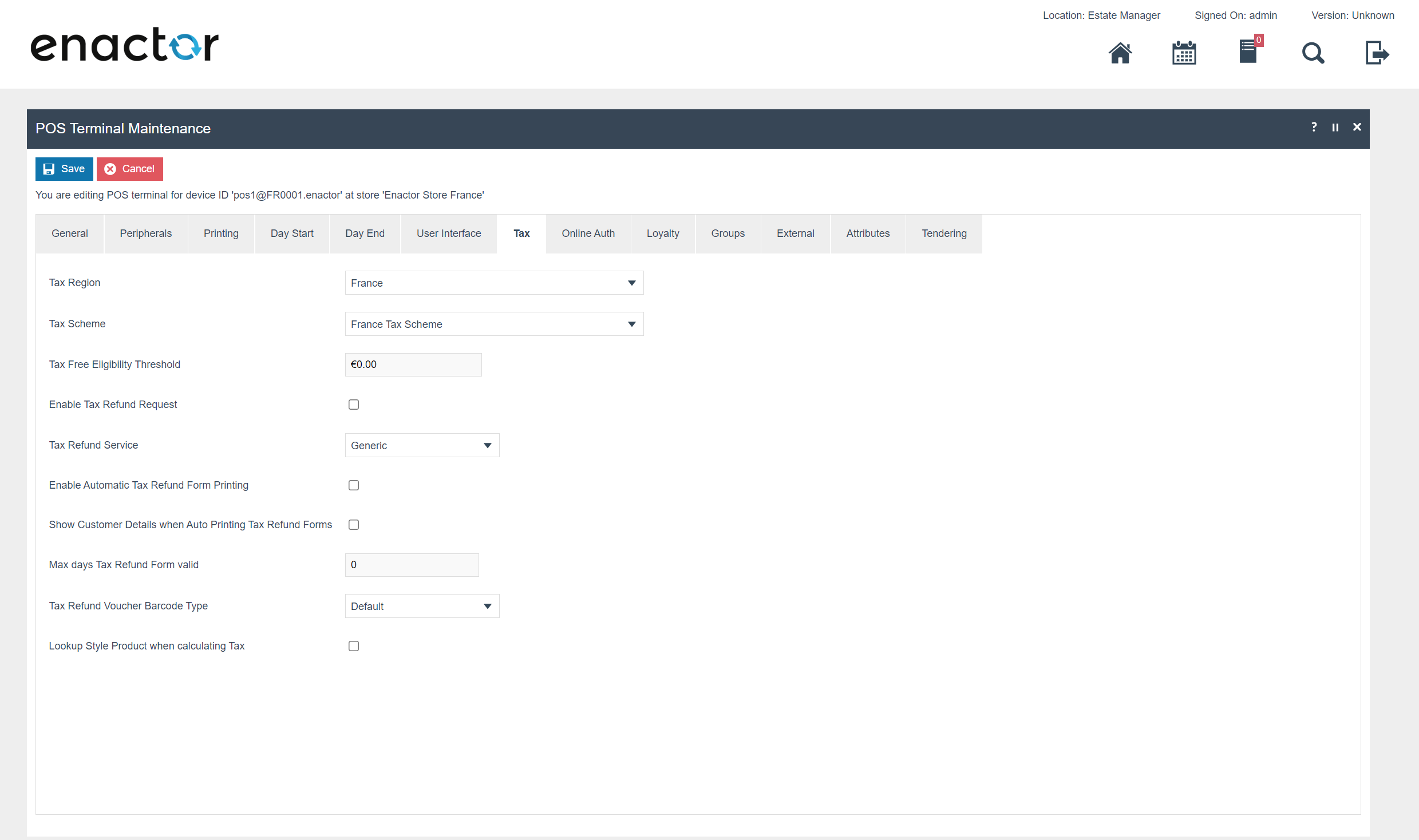

POS Terminal

The POS Terminal Template used by all devices in Croatia must be configured to have the fiscalisation Type set to Croatia.

Currency should be set to Croatia Kuna and Locale to Croatia.

Operator View Parent Theme and Operator View Theme under Pos Terminal >

User Interface > Branding / Style should match the values from the

enctor.xml theme configuration.

Menu Group and Default Menu Group under User Interface > General should match the original menu group.

If a POS terminal configuration with the fiscalisation type set to Croatia is broadcast to a POS device that does not have the Croatia fiscal module installed the POS will fail to start. Similarly if a POS device with the Croatia fiscal module installed is configured with anything but the Croatia fiscalisation type the POS will also fail to start. This is to ensure that only versions of the enactor solution that have been certified for use in Croatia are used in Croatia.

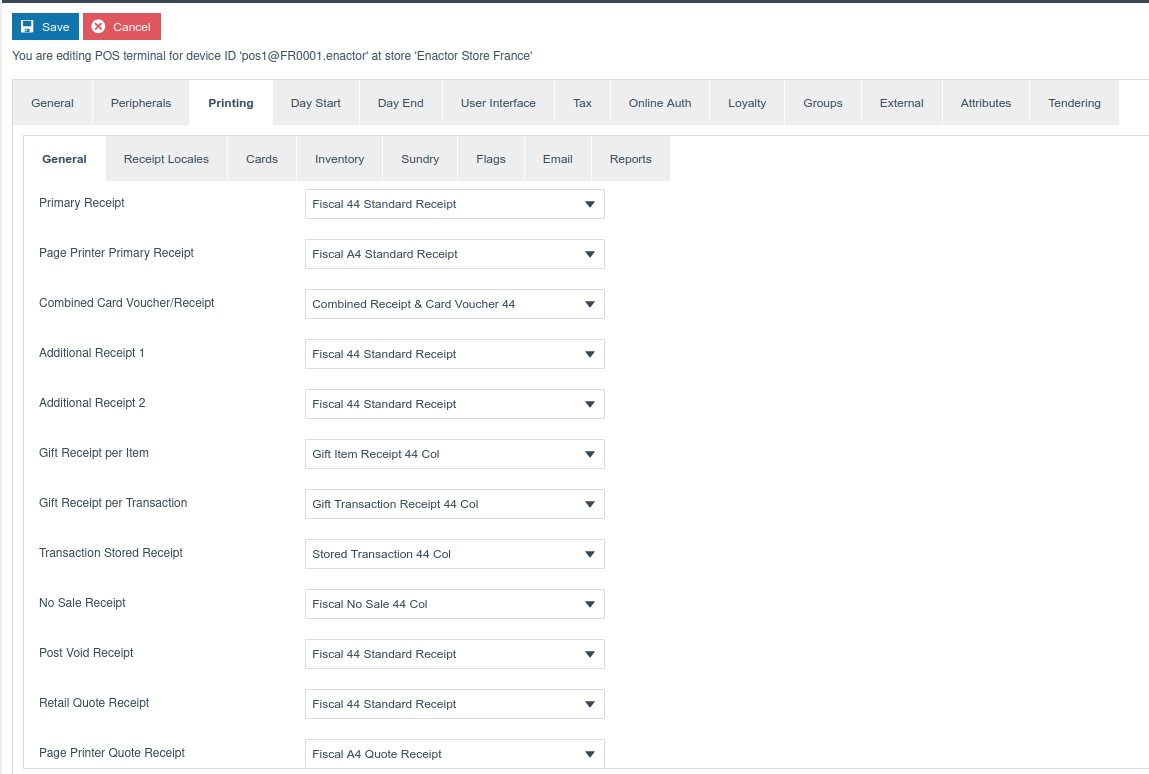

The primary Receipt should be set to Fiscal Standard Receipt 44.

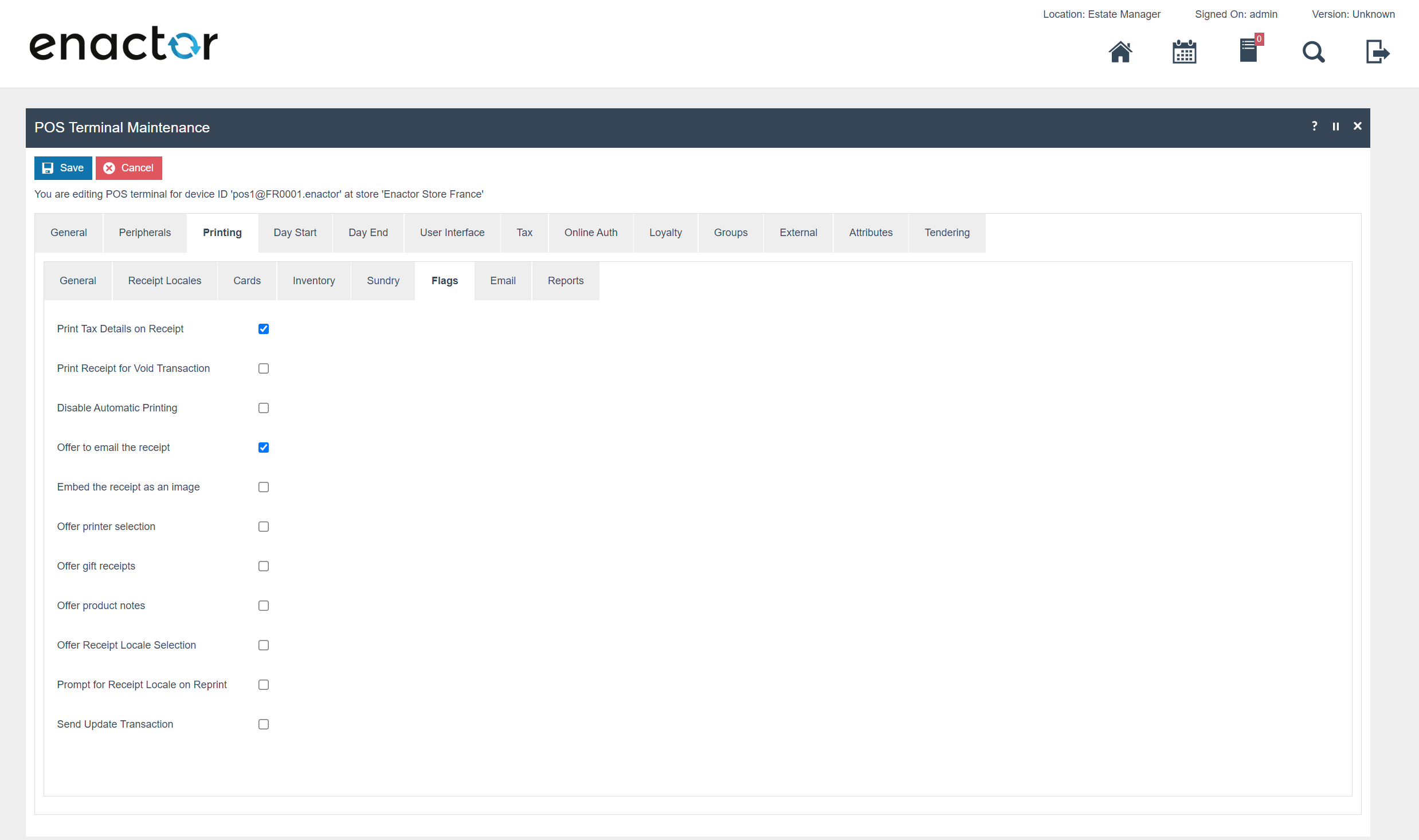

The ‘Print Tax Details on Receipt’ flag within Printing > Flags should be ticked.

Within the Tax section the Tax region should be set to Croatia and the tax scheme to the Croatia tax scheme configured in the previous section.

Products

Set the Tax group and Price for each product (Currency : Kn)

For more detail on product creation refer to the How-To Guide Configuring a Merchandise Product and How-To Guide Configuring Product Prices

Menu

Sale menu

On the EM navigate to Configuration > System > Menu.

-

Edit the “SALE” menu for the Menu Group “Standard POS”.

-

Add a folder under “Sales > Receipts” called “Fiscal Receipts”.

-

Add new buttons to the Fiscal Receipts folder for the following:

| Event | ID | Button Label |

|---|---|---|

| RequestSimpleFiscalInvoice | RequestSimpleFiscalInvoice | Request Simple Fiscal Invoice |

For more detail on menu creation refer to the How-to Guide Configure POS Behaviour (Menus)

Tenders

Tender Types mapping

-

Cash - G

-

Card - K

-

Cheque - C

-

Bank Transfer - T

-

Other - O

Configuration

FiscalTenderId will be set as the above legal requirement for Croatia

| Tender Id | Description | Region | Currency | Fiscal Tender Type | Fiscal tender ID |

|---|---|---|---|---|---|

| CASH_HR | Cash | Croatia | Kn | Cash | G |

| CARD_HR | Card | Croatia | Kn | Card | K |

| CHEQUE_HR | Cheque | Croatia | Kn | Cheque | C |

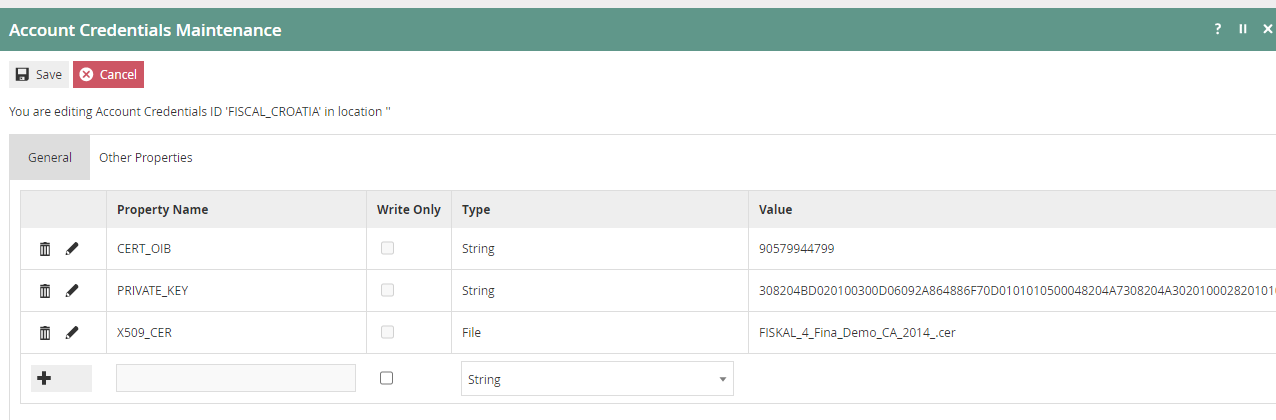

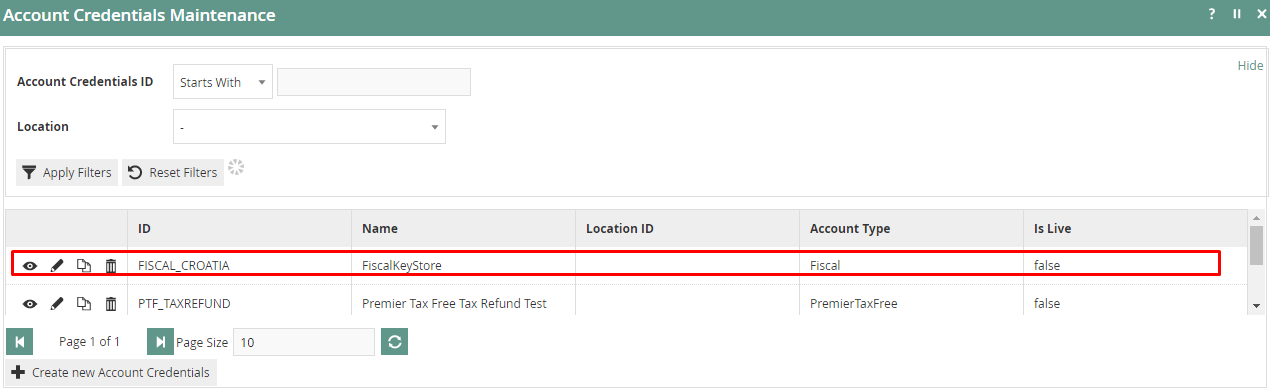

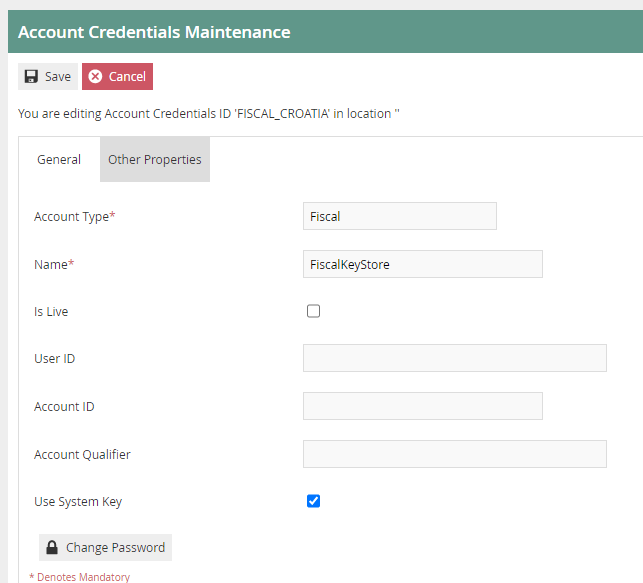

Account Credentials

Add new Credential for retrieving Croatia Tax Authority Certificate. Create New Account Credentials Entry as follows.

Update following in the General Tab

| Field Description | Value | Comments |

|---|---|---|

| ID | FISCAL_CROATIA | Update Field |

| Account Type | Fiscal | Update Field |

| Name | FiscalKeyStore | Update Field |

| Use System Key | true | Tick the check box |

Update following in the Other Properties Tab

| Property Name | Type | Value | Comments |

|---|---|---|---|

| CERT_OIB | String | 90579944799 | obtained from the certificate |

| PRIVATE_KEY | String | 308204BD020100300D06092A864886F70D0101010500048204A7308204A3020100028201010099CD85701AC9851902CFFD25429164924B775D691DBC96ED2767460E729C74ED4D9CA540B26648620CD456193B8F63933D0A0871A3EAD211D116F31ADD8335407972508D76894019C1F9866370784C13729C2F0B8BEBE7320F1B999BF51E79D9D9C182AB0D04082474531A8E4D4FE9A68679E2B77C594F54E0D0FEF50DF2F0136F167483DF3B302DA9398D70DC972433E57DBD942B2E50C60EC2BD770F2501AD65D63F6B50FD06DC605EBF622B8D8D302B7C0BEA1AE4A1BF490551186AA20710132987CD2D7387D8132E858CD205A610C0C3843A03B024EEBCED1BA6C9EC7E3F8552172A6200B57FB0C822DD34E98FAC911BA49B52246B08BCF8B23C20DD7401020301000102820100204A2CAC97831D655DD8CABDCAD6F9755950AB14C980717342A584E8BD99295734C7214E8EE5B8669568F2D683519C472A3674055FB389FCE197DEDC120B5CDFB75F8F97D37E072E213240CB99AE37D2916A46DA36BB0523D656260EBF0C71EA91B3F5B9F1969A1B052CF9534CD9ED24DFF0B0EF72B4D159F1850F31E586CE6E028DF1D0E06E950342396828EEF028EC9E72631B3B7F0FFF404D2147DDEEA514A1F9296477B5878D29AD37A32A6359801C4DD94DDCE8CAB1B4388FC5D8485832D168E21341A27B97D6AFD8B6EAFB1B4227AFC2E1A291D1D3BF277B64AAED495D41CD5D84BDA889C5010B89CB728A1C23FBC1845A7FEAD0A2C4E367286E44DF5102818100D4829CD3C3836E14AD2151315CBD379A9F5FE67B16544801CAF8D3EA62A2CAB57BE9FC9EECFB87D5CBF46EAF73B138936C7D4AE3D0378CDF9325A84288F872B61A96B938A0D45294D9ED74C195279B1876120729975FED2A323DB0B706F3D5E6C57FB499B699C7D8572C43555F15B7EC2A7167A59D922F507A77B06F89C1FCBD02818100B9473C16D8942CDC9F5997516F0C5E1E39B98FEB21CBC5DA87D7A6BC4399362503828DAD04DF9759771A9065DFFBF679D8480CE2F939B68D02227E0D7E6A1B0004AC4501403FC60C6C7B7B21AFDA1CCEE4F9D16F5C73DC0C57B818B6BF31F56BD601D7CCB07068D0BBB54F8076088F3E03184F27F946FFB91FDFFD6484D9629502818100AD8CE5AB03D708459686C91A3914C69E5E5E218A9057D05EB676B40A8CF749F920F39CBDE5E81DACFADDEAAF1B1AB68B9F644B8EF57308776662B0A175DF013FBB43308D10BB959DBEC4703FD0220245DDD727464E3BA72278D96CC26CC921FD4F79D5F25AF00807A4599FBBCEE59BC92178701F0F2A5DBDA9E6A98ECDC04139028180748D4E4CA4E3D9B0D4015D025A543264DB355346BC14DF1B10B765692B311771835ABE5B2824ABA61919B9DA8C638972AECEEC646019A12FE536E38B038A260005F084DC3B99A2B1B010A1ADD85CE22078C47AAE8E3F481EEF939CE0613841461BF33ED8C1E984D6422ED59B5F25154F124D598630F72BE93E16FEE51BF9505D0281807915C002056C39CE095950F5C4F67BA2AEE22EAE880A16BCD8ED93F48905E6ED8BD3FB2A7041B0E5003CE6B22BC05543282678E9FE401EC6EC59E9FDDCAB4B246151B2ADBA7CE9DA18D89C42D66140D5B10D71284727A20B07C82DBA4253CDAAAB871ED3C6BAA2B3C6603BED7F790776B19F29D8EE8AB4A0A32188279973EB12 | Update Field |

| X509_CERT | File | FISKAL_4_Fina_Demo_CA_2014_.cer | Demo Certificate File should be uploaded here |