How To Guide Fiscal Norway

Fiscal Overview

For shared background, see Fiscal Overview.

Norway Description

The fiscal approach in Norway is based around signing transactions. It is not necessary to use an external device for this signing process. Instead each POS manufacturer must declare to the Norwegian Tax authority that their POS software is compliant and when making this declaration they must supply the public key from the key pair used to sign each transaction.

The POS software must also provide a function to export transactions in the SAF-T file format specified by the Tax Authority. The retailer is then responsible for submitting the SAF-T file to the Tax Authority who can then use the public key provided by the POS supplier to ensure that no records have been modified. This process is described in more detail in the following document supplied by the Norwegian Tax Authority: https://www.skatteetaten.no/globalassets/bedrift-og-organisasjon/starte-og-drive/rutiner-regnskap-og-kassasystem/saf-t-regnskap/requirements-and-guidelines-for-implementing-digital-signatures-in-cash-register-systems.pdf

As well as the requirement to sign, record, and prevent the modification of transactions, the legislation in Norway places requirements on the POS for functions that must and must not be present. The requirements are well documented in an English translation maintained by the Norwegian Authorities: https://lovdata.no/dokument/SFE/forskrift/2015-12-18-1616/

The primary required and forbidden functions are described in the following lists.

Required:

-

The cash register system must be able to register a change float.

-

The cash register system must be able to register different means of

payment.

-

The cash register system must have a clock. The clock must be set to

Norwegian standard time and adjusted for summer time during the summer.

-

The cash register system must clearly differentiate between positive

and negative amounts on all receipts and reports and in the electronic journal.

-

Cash register systems intended for use by several enterprises with a

bookkeeping obligation must be organised in such a manner that all continuous use, including means of payment, is registered separately for each enterprise with a bookkeeping obligation

-

Each POS must have a cash draw except where cash is not accepted

Forbidden:

-

The software in a cash register system must not include any other

functions than those stipulated in the system documentation.

-

The software in a cash register system must not be capable of being

connected to or integrated with equipment or software that make it possible to alter or delete the electronic journal.

-

The software in a cash register system must not include functions that

make it possible for the user to remove, alter or add information to registrations. It must not be possible to change pre-programmed text for goods and services during or after registration.

-

It must not be possible to conclude a sale without the system printing

a sales receipt. The requirement for the cash register system generating a print automatically does not apply if there is a payment solution which is integrated with the cash register system.

-

The system must not be capable of printing more than one copy receipt.

This does not prohibit tax free stores at airports printing several STEB copies.

-

It must not be possible to carry out registrations in the cash

register system if the integrated cash box is open.

-

It must not be possible to carry out registrations in the cash

register system if the storage memory is full.

-

It must not be possible to mark particular goods or services in the

cash register system so that they are not included in X reports and Z reports.

-

A cash register system that is connected to a non-automatic weighing

instrument must not be capable of affecting the instrument's measurement properties.

System Description

The enactor system is distributed, there is a central component called the Estate Manager (EM) where configuration is performed and which is the master data store for the system configuration. Configuration performed on the EM must be broadcast to the POS devices before it takes effect. The system is extremely configurable but only a small subset of this configuration is required to ensure that the Norwegian Fiscal legislation is complied with. This required configuration is described later in this document and there are further how to guides available which described the other configuration options available see https://insights.enactor.co/ The critical configuration option for Norway is the fiscalisation type on the POS terminal, when this is set to Norway, the rules of the Norwegian fiscal legislation will be applied on that device (POS). In case the EM is used to configure the system in a way that would not be compliant in Norway, the POS will be prevented from starting where its fiscalisation type is set to Norway. Once a POS has been configured as a Norwegian fiscal POS it is not possible to change or remove the fiscalisation type.

As well as being the master data store for configuration the EM is also the master data store for the transactions that are performed on the POS. Transactions are also stored on the POS and the store server at the time of the sale. However the purging of the data on the store server and the POS databases is usually relatively short, days/weeks rather than the years, data would be retained on the EM. Although transaction data is purged from the POS this would not be done until it had been transmitted to the EM and a Z report has been run for any transactions being purged.

At the time transactions are performed on the POS they are signed as described in the document https://www.skatteetaten.no/globalassets/bedrift-og-organisasjon/starte-og-drive/rutiner-regnskap-og-kassasystem/saf-t-regnskap/requirements-and-guidelines-for-implementing-digital-signatures-in-cash-register-systems.pdf. These transactions are then stored along with their signature in a commercially available SQL database application. A number of database application are supported by the solution to account for the different licensing agreements that retailers already have in place. These include Oracle, MySQL, MSSQL and MariaDB, in all cases the standard authentication mechanisms are used to ensure that user access is restricted and that data cannot be deleted or modified by unauthorised users.

The method and structure used to retain and protect data on the store server and the EM is the same as that on the POS. When transactions are transmitted from the POS to the Store Server and then from the Store Server to the EM they are protected by SSL. Data is submitted to the Store Server and then to the EM in near real time and would expect to be processed into the database within minutes in a normally operating system. Queues are used to ensure that data is still retained in the case of abnormal operation, such as network outages. The application also uses a system of sequence numbers to identify situations where transactions are not flowing through the system as expected.

Should an inspection of the data be required in a production environment, Enactor will be able to provide access to the database directly so that the tables containing transactions and their signatures can be inspected. A function is provided within the EM that allows the data to be exported in the SAF-T format as required by the legislation.

As well as sales and returns the POS will also record other events in the database as required to produce the SAF-T file. These are also transmitted to the Estate Manager and its database is the fiscal record.

These events include:

-

Receipt Copy

-

Floats

-

Pickups

-

X and Z reports

-

Cash Drawer Open/No Sale

Returns are typically performed as receipt returns where the original sale is linked to the return either by scanning the original sale receipt barcode or searching for the original sale on the POS. However it is possible to perform a non-recipitated return, this would be used in a couple of scenarios. The customer no longer has the original receipt or remembers enough details about the transaction (Store, Date, Time) to find the transaction with a search, but the retailer still wishes to return the item as a gesture of goodwill. Alternatively, the sale was performed on a system other than enactor, i.e. web order or sale from the previous POS solution. In these cases the return is signed and recorded as usual but there will not be a reference to the original sale in the return transaction record.

Fiscal Module Version Declarations

| Model | Version | Comment |

|---|---|---|

| ENACTOR | 1.0 | Initial Declaration, not deployed in any production environments. |

| ENACTOR | 1.0.277 | Fixed defect with wrong software version being used in the SAF-T file, released to Lindex. |

| ENACTOR | 1.0.303 | Resolved issues with x and z report. (non-production release) |

Configuration Overview

The following configuration changes are needed and should be broadcast to all Norwegian devices in preparation for go live. ID’s below follow the enactor naming convention, but each retailer is free to use their oven naming conventions to match configuration used in other counties.

Tax

Tax Groups

The following tax groups should be configured and broadcast to the Norwegian devices.

| Tax Group ID | Description |

|---|---|

| NO1 | NO Normal Tax Group |

| NO2 | NO Reduced Tax Group 1 |

| NO3 | NO Reduced Tax Group 2 |

Tax Schema

The following tax schema should be configured and broadcast to the Norwegian devices.

| Tax Schema ID | Description | Price Include Tax |

|---|---|---|

| NO | NO VAT | TRUE |

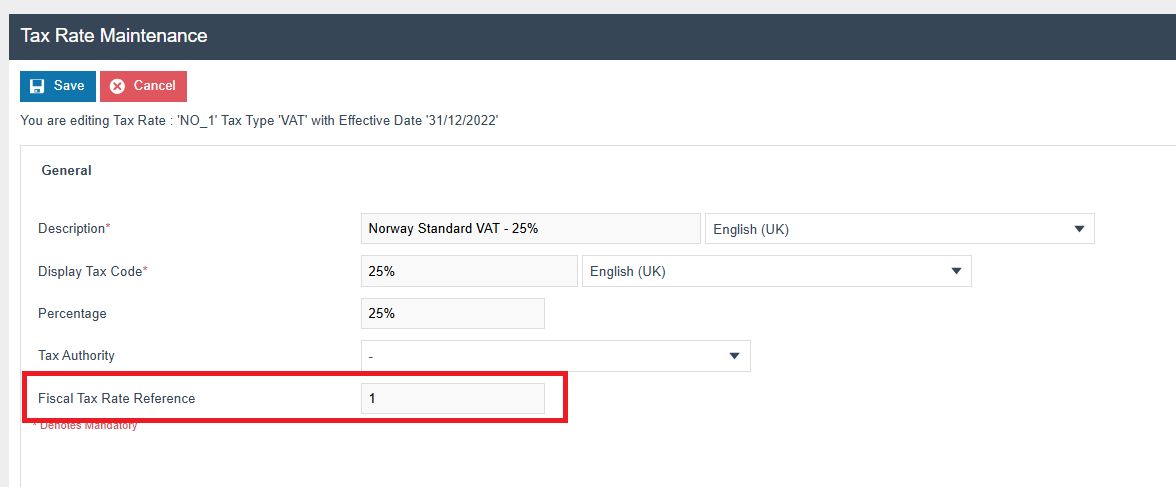

Tax Rates

The following tax rates should be configured and broadcast to the Norwegian devices.

| Tax Rate ID | Description | Display Code | Percentage |

|---|---|---|---|

| NO _R1 | NO Normal | 1 | 25% |

| NO _R2 | NO Reduced 1 | 11 | 15% |

| NO _R3 | NO Reduced 2 | 12 | 12% |

The Standard VAT code should be configured in the Fiscal Tax Rate Reference

The following table from the Norwegian Tax authority GitHub https://github.com/Skatteetaten/saf-t/ should be consulted to see what each rate's display code should be. This will be used both for the Tax breakdown on the X/Z report and the SAF-T file.

| Code | DescriptionNOB | DescriptionENG | TaxRate | Compensation |

|---|---|---|---|---|

| 0 | Ingen merverdiavgiftsbehandling (anskaffelser) | No VAT treatment | TRUE | |

| 1 | Fradragsberettiget innenlands inngående merverdiavgift | Input VAT deductible (domestic) | Regular rate | TRUE |

| 11 | Fradragsberettiget innenlands inngående merverdiavgift | Input VAT deductible (domestic) | Reduced rate, middle | TRUE |

| 12 | Fradragsberettiget innenlands inngående merverdiavgift | Input VAT deductible (domestic) | Reduced rate, raw fish | |

| 13 | Fradragsberettiget innenlands inngående merverdiavgift | Input VAT deductible (domestic) | Reduced rate, low | TRUE |

| 14 | Fradragsberettiget innførselsmerverdiavgift | Input VAT deductible (paid on import) | Regular rate | TRUE |

| 15 | Fradragsberettiget innførselsmerverdiavgift | Input VAT deductible (paid on import) | Reduced rate, middle | TRUE |

| 20 | Kostnad ved innførsel av varer, ingen merverdiavgiftsbehandling | No VAT treatment | TRUE | |

| 21 | Kostnad ved innførsel av varer | Basis on import of goods | Regular rate | TRUE |

| 22 | Kostnad ved innførsel av varer | Basis on import of goods | Reduced rate, middle | TRUE |

| 3 | Utgående merverdiavgift | Output VAT | Regular rate | |

| 31 | Utgående merverdiavgift | Output VAT | Reduced rate, middle | |

| 32 | Utgående merverdiavgift | Output VAT | Reduced rate, raw fish | |

| 33 | Utgående merverdiavgift | Output VAT | Reduced rate, low | |

| 5 | Innenlands omsetning og uttak fritatt for merverdiavgift | No output VAT | Zero rate | |

| 51 | Innenlandsk omsetning med omvendt avgiftplikt | Domestic sales of reverse charge /VAT obligation | Zero rate | |

| 52 | Utførsel av varer og tjenester | Export of goods and services | Zero rate | |

| 6 | Omsetning og uttak utenfor merverdiavgiftsloven | Not liable to VAT treatment, turnover and withdrawals outside the scope of the VAT legislation | ||

| 7 | Ingen merverdiavgiftsbehandling (inntekter) | No VAT treatment - no turnover according to the VAT legislation | ||

| 81 | Grunnlag innførsel av varer med fradragsrett for innførselsmerverdiavgift | Importation of goods, VAT deductible | Regular rate | TRUE |

| 82 | Grunnlag innførsel av varer uten fradragsrett for innførselsmerverdiavgift | Importation of goods, without deduction of VAT | Regular rate | TRUE |

| 83 | Grunnlag innførsel av varer med fradragsrett for innførselsmerverdiavgift | Importation of goods, VAT deductible | Reduced rate, middle | TRUE |

| 84 | Grunnlag innførsel av varer uten fradragsrett for innførselsmerverdiavgift | Importation of goods, without deduction of VAT | Reduced rate, middle | TRUE |

| 85 | Grunnlag innførsel av varer som det ikke skal beregnes merverdiavgift av | Importation of goods, not applicable for VAT | Zero rate | TRUE |

| 86 | Tjenester kjøpt fra utlandet med fradragsrett for merverdiavgift | Services purchased from abroad, VAT deductible | Regular rate | TRUE |

| 87 | Tjenester kjøpt fra utlandet uten fradragsrett for merverdiavgift | Services purchased from abroad, without deduction of VAT | Regular rate | TRUE |

| 88 | Tjenester kjøpt fra utlandet med fradragsrett for merverdiavgift | Services purchased from abroad, VAT deductible | Reduced rate, low | TRUE |

| 89 | Tjenester kjøpt fra utlandet uten fradragsrett for merverdiavgift | Services purchased from abroad, without deduction of VAT | Reduced rate, low | TRUE |

| 91 | Kjøp av klimakvoter eller gull med fradragsrett for merverdiavgift | Purchase of emissions trading or gold, VAT deductible | Regular rate | TRUE |

| 92 | Kjøp av klimakvoter eller gull uten fradragsrett for merverdiavgift | Purchase of emissions trading or gold, without deduction of VAT | Regular rate | TRUE |

Tax Group Tax Methods

The following tax group tax methods should be configured and broadcast to the Norwegian devices.

| Tax Group ID | Tax Scheme ID | Description | Tax Rate | |

|---|---|---|---|---|

| NO _1 | NO | NO Normal | NO Normal | |

| NO _2 | NO | NO Reduced 1 | NO Reduced 1 | |

| NO _3 | NO | NO Reduced 2 | NO Reduced 2 |

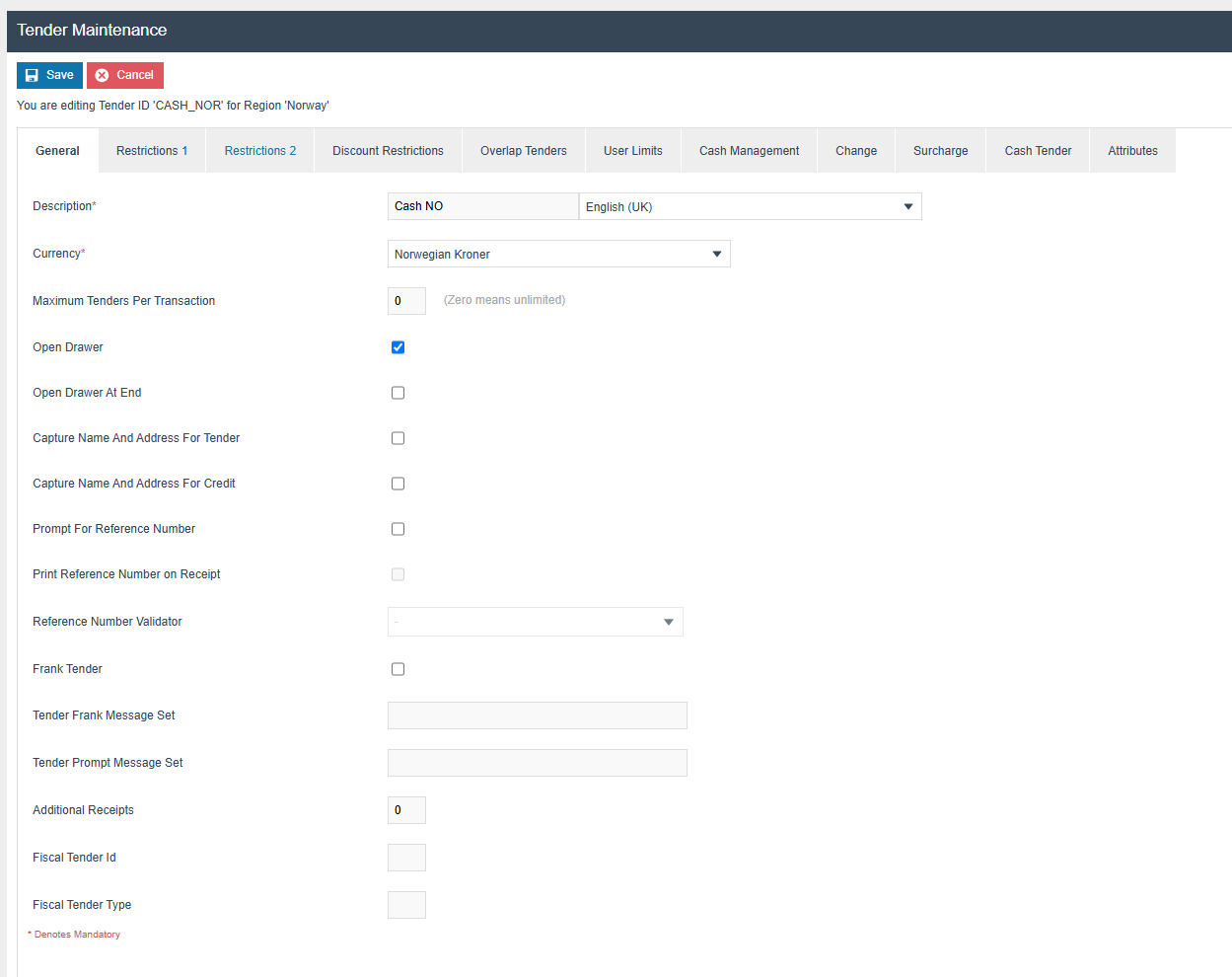

Tenders

When setting up tenders for use in Norway they need to be configured with a fiscal tender ID

Set the value in the Tender Maintenance → General → Fiscal Tender Type the value that should be shown under Standard Payment Type on the X/Z reports.

Each tender needs to map to the corresponding PredefinedBasicID-12 from the Norwegian Tax Authority GitHub https://github.com/Skatteetaten/saf-t/ which is shown below for ref.

| PredefinedBasicID-12 | CodeDescriptionENG | CodeDescriptionNOB |

|---|---|---|

| 12001 | Cash | Kontant (alle typer valuta) |

| 12002 | Debit card | Bankkort (debet kort) |

| 12003 | Credit card | Kredittkort |

| 12004 | Bank account | Bankkonto |

| 12005 | Gift token | Gavekort |

| 12006 | Customer card | Kundekonto |

| 12007 | Loyalty, stamps | Lojalitetspoeng |

| 12008 | Bottle deposit | Pant |

| 12009 | Check | Sjekk |

| 12010 | Credit note | Tilgodelapp |

| 12011 | Mobile phone apps | Mobiltelefon løsninger, ulike betalingsapplikasjoner |

| 12999 | Other | Øvrige |

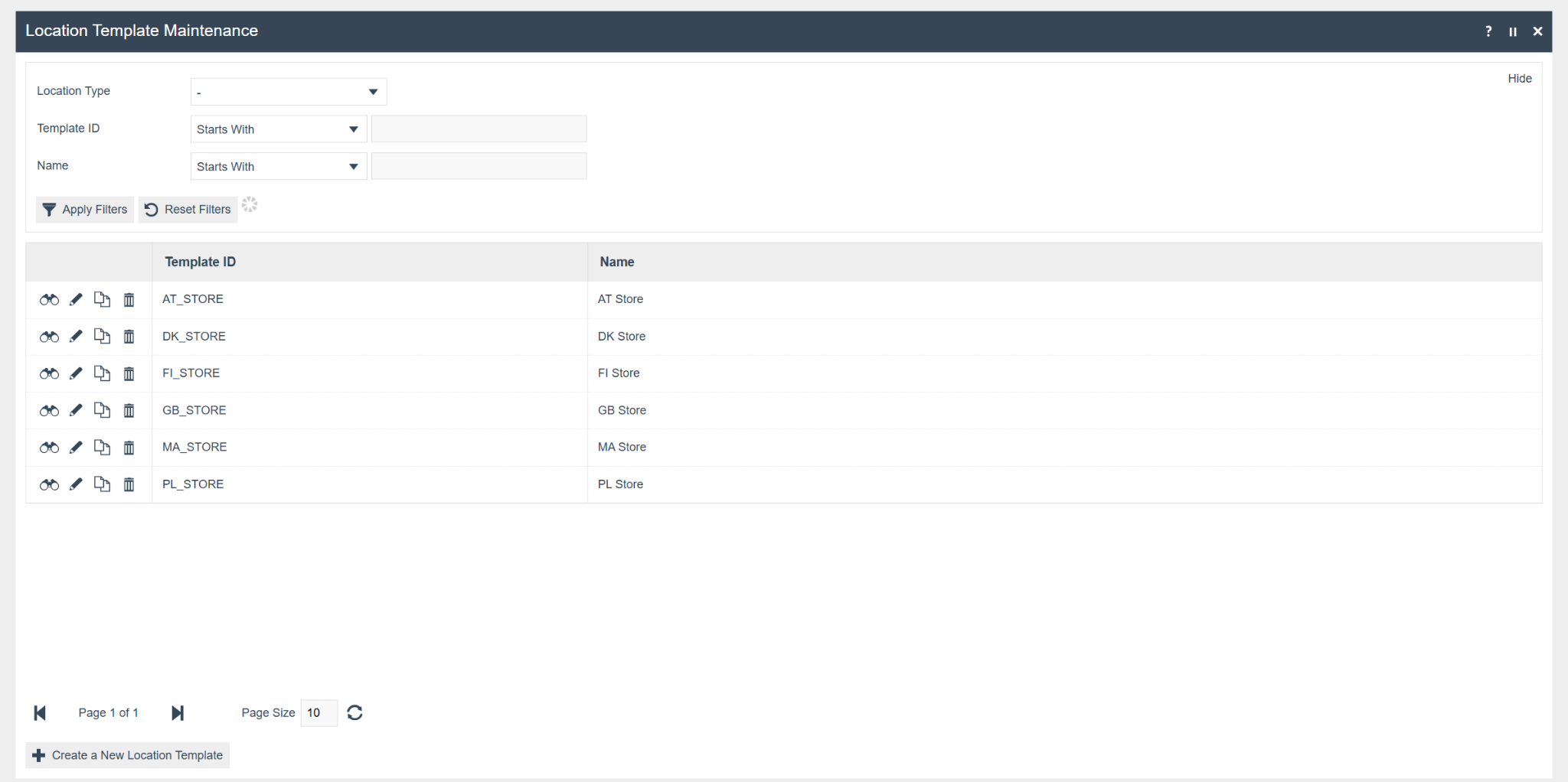

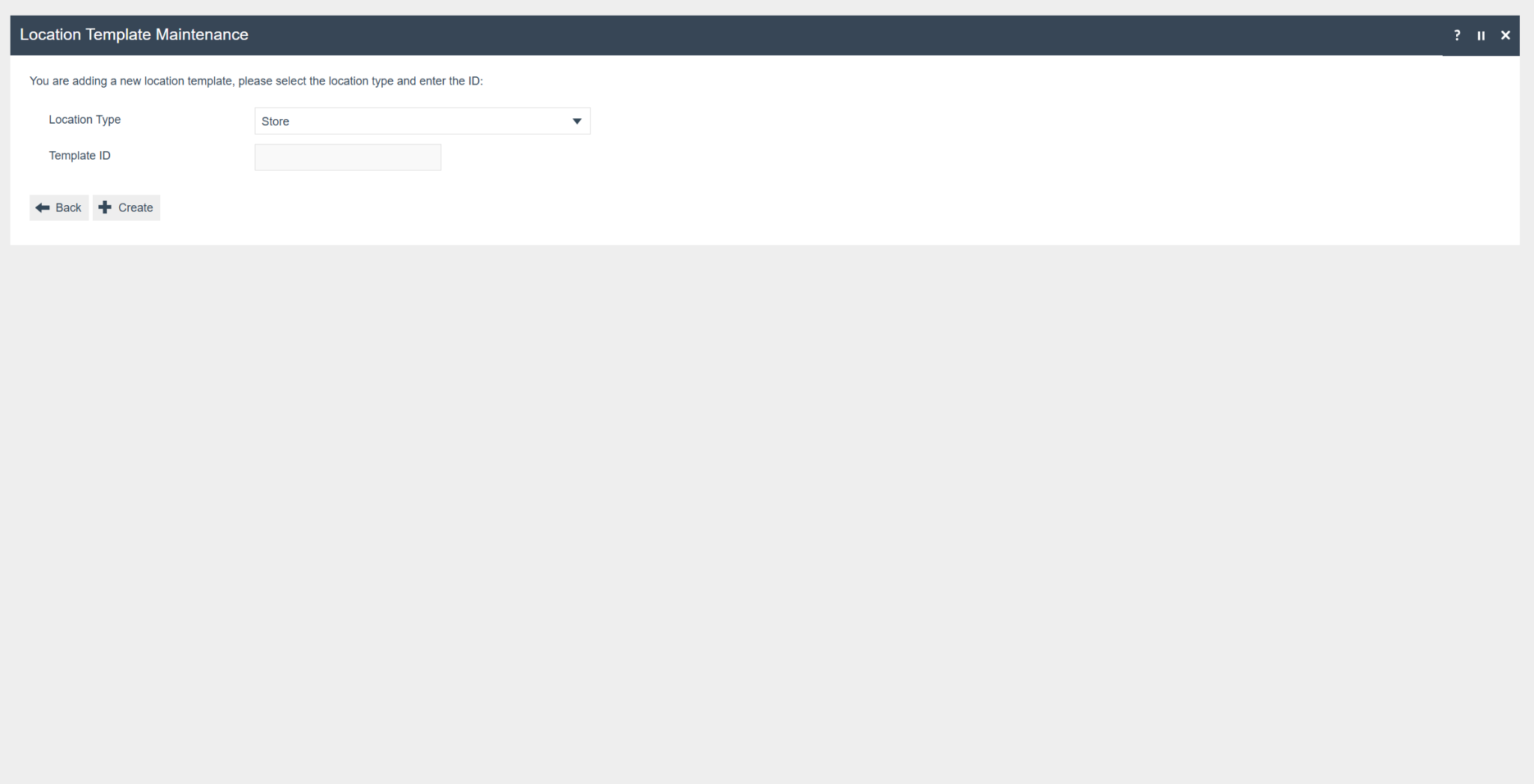

Location Terminal Template

Search for Location Template within the EM and click to edit this entity. From the screen that is shown create a new template for the Norwegian stores, by clicking create a new Location Template.

Give the template a sensible name e..g. NO_Store and select store as the location type.

From here you can populate the common values for the NO locations VAT No should be set to your organisation's Norwegian VAT No as this is used to produce the SAF-T file. The locale should also be set to Norway. See the https://insights.enactor.co/ for further details on configuring the location template.

N.B. This can be done at a store by store level rather than using a template but this is not recommended as it is more prone to error.

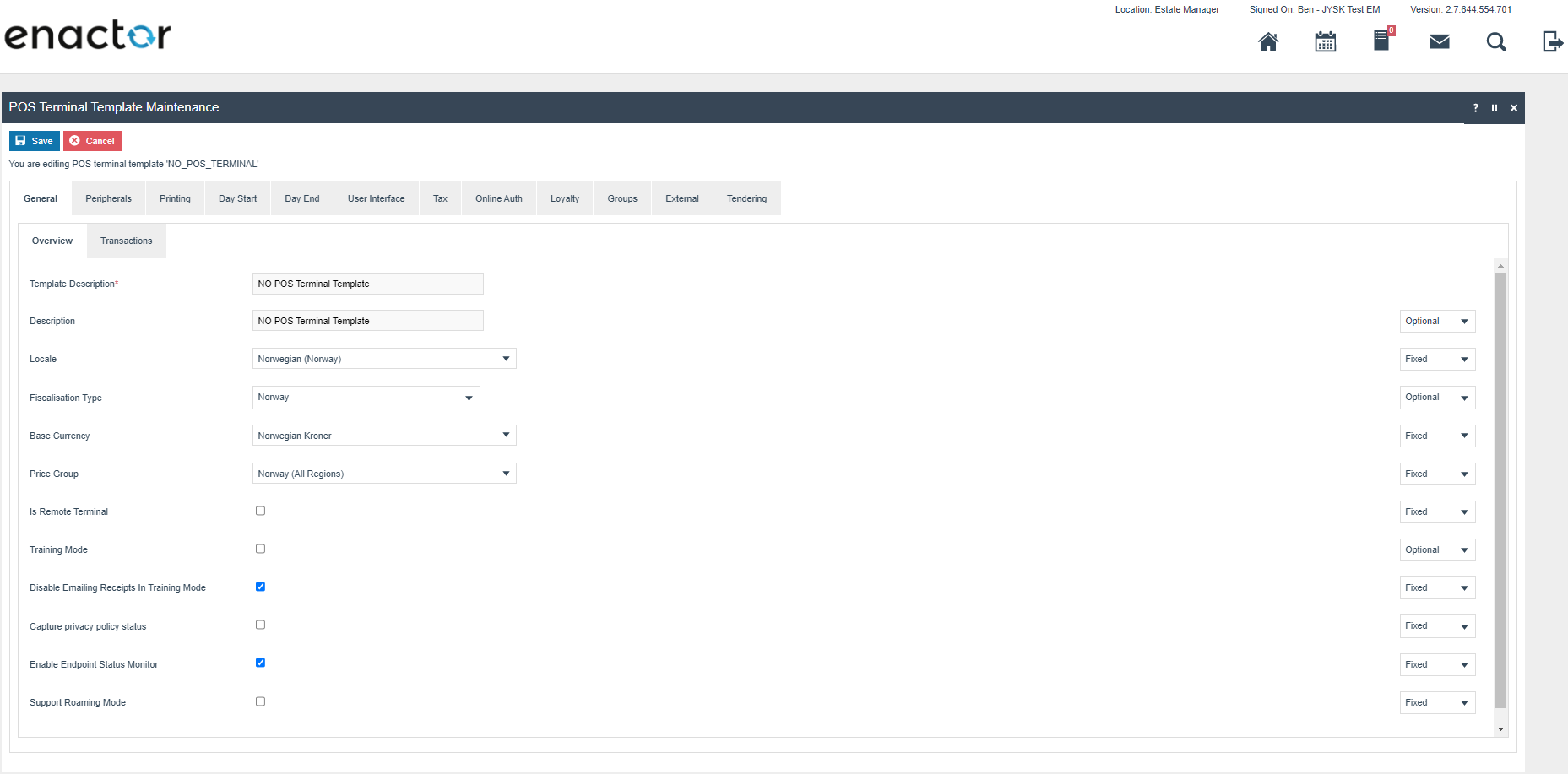

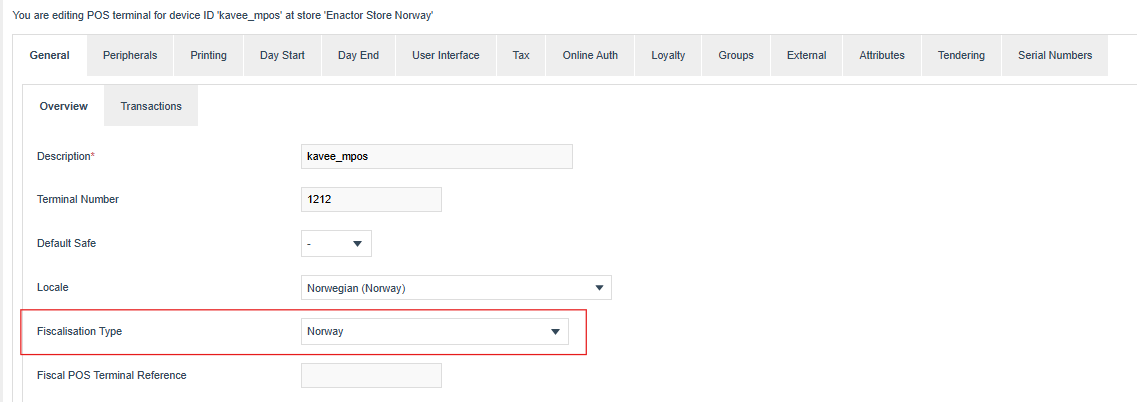

POS Terminal Template

The POS Terminal Template used by all devices in Norway should be configured to have the fiscalisation Type set to Norway. Currency should be set to Norwegian Kroner and Locale to Norwegian. The Enable end point status monitor should be checked.

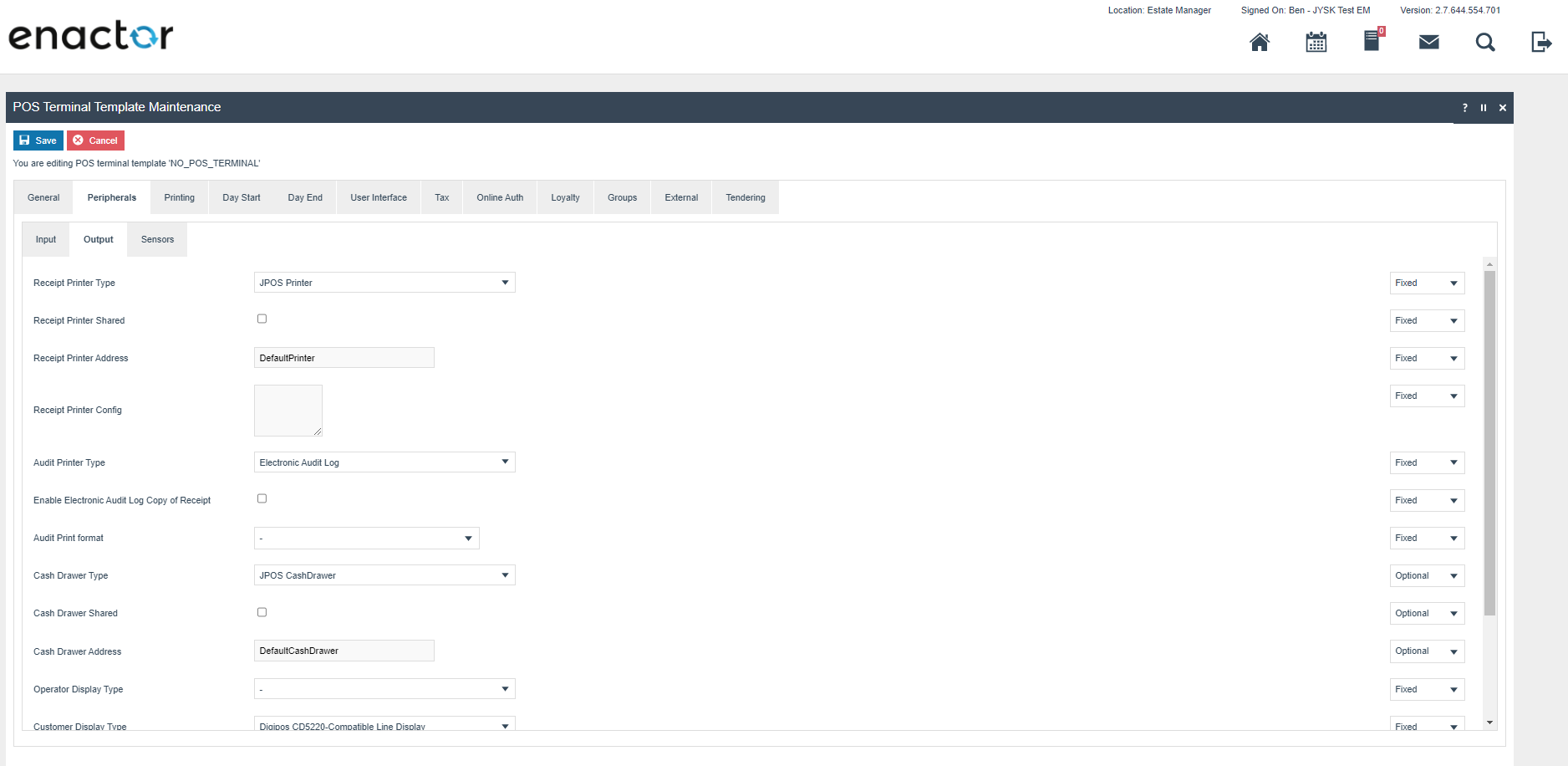

Within the peripherals tab the Audit printer type needs to be set to Electronic Audit log.

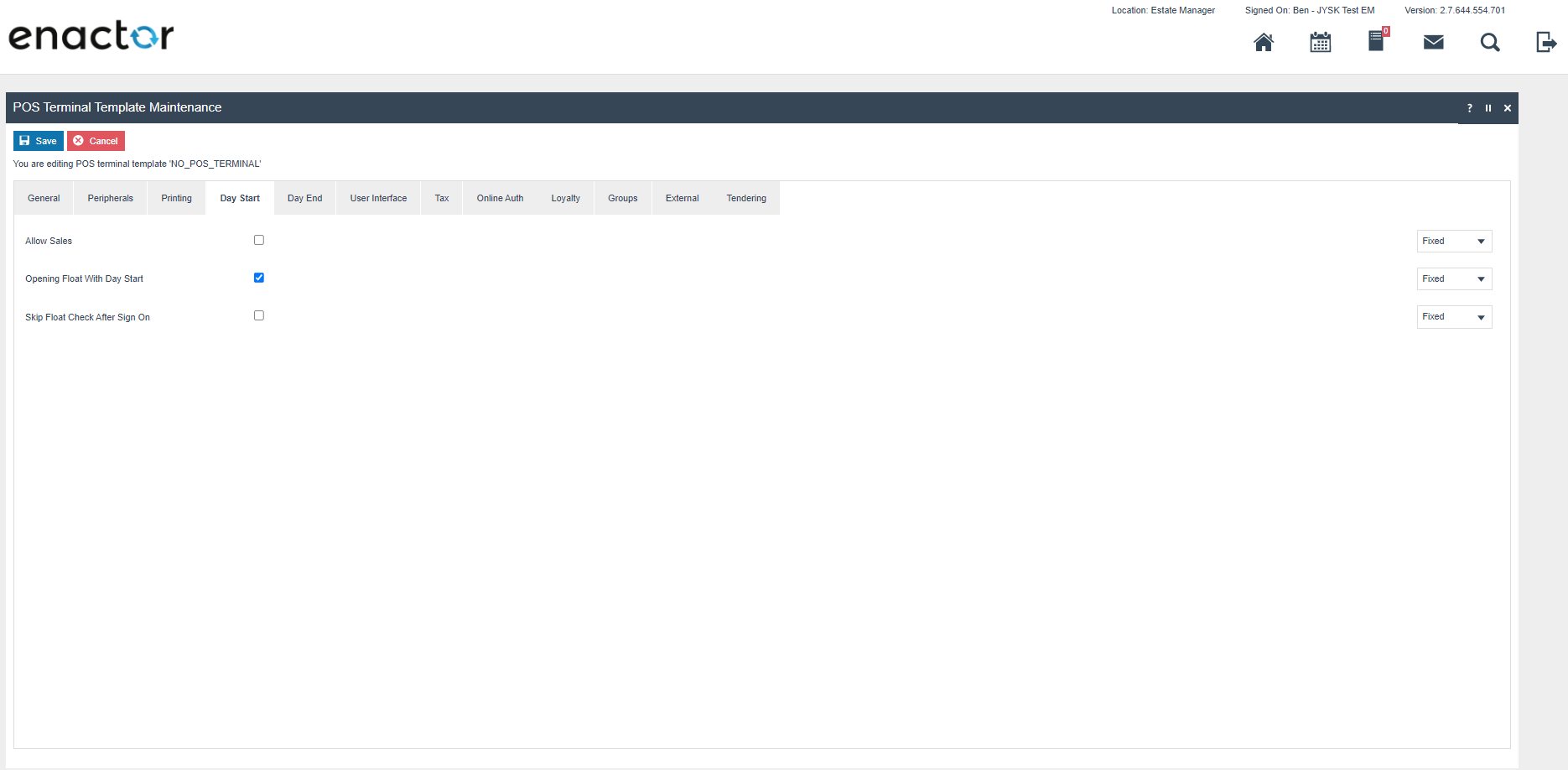

On the day start tab the opening float with day start must be checked.

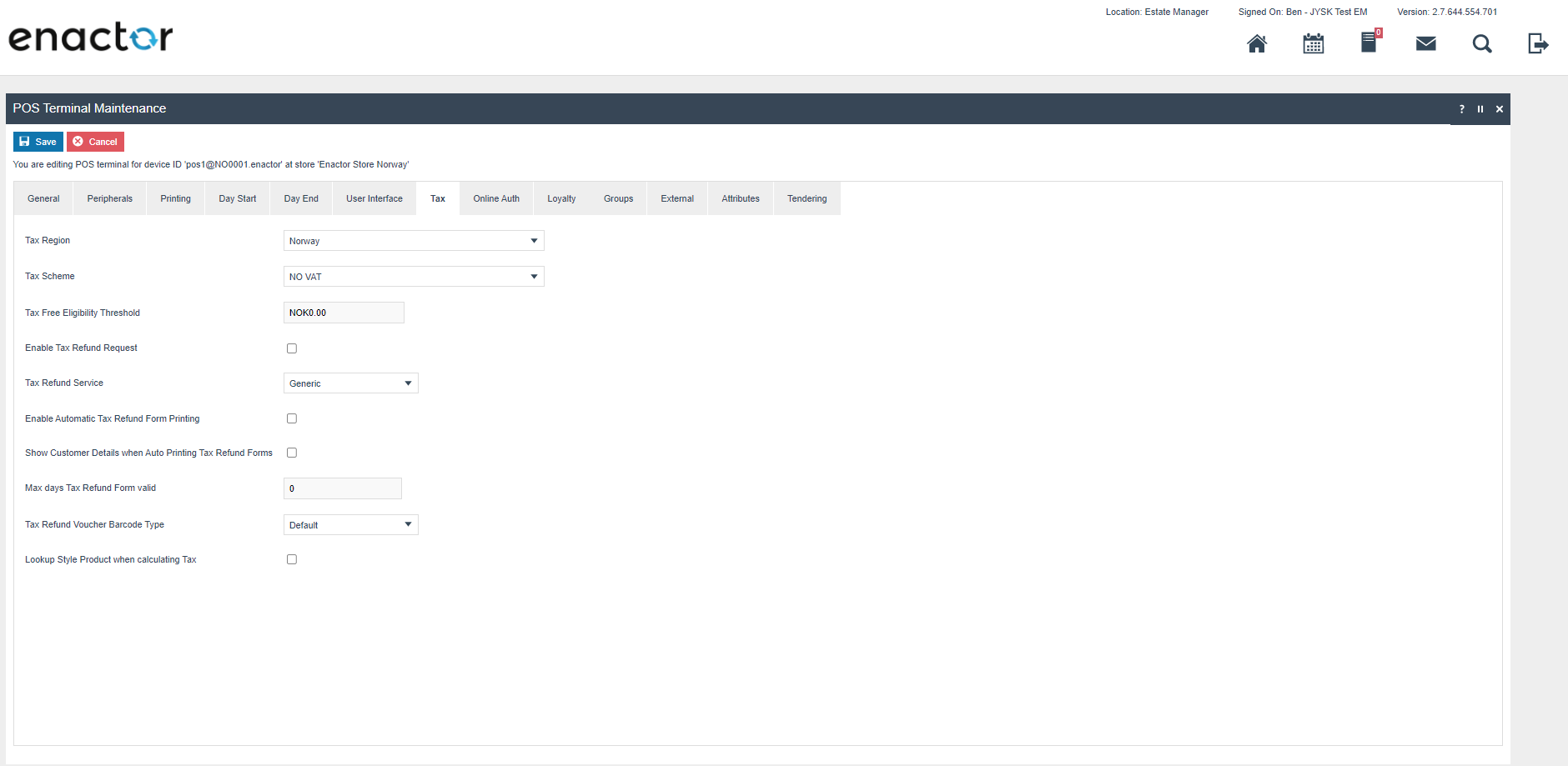

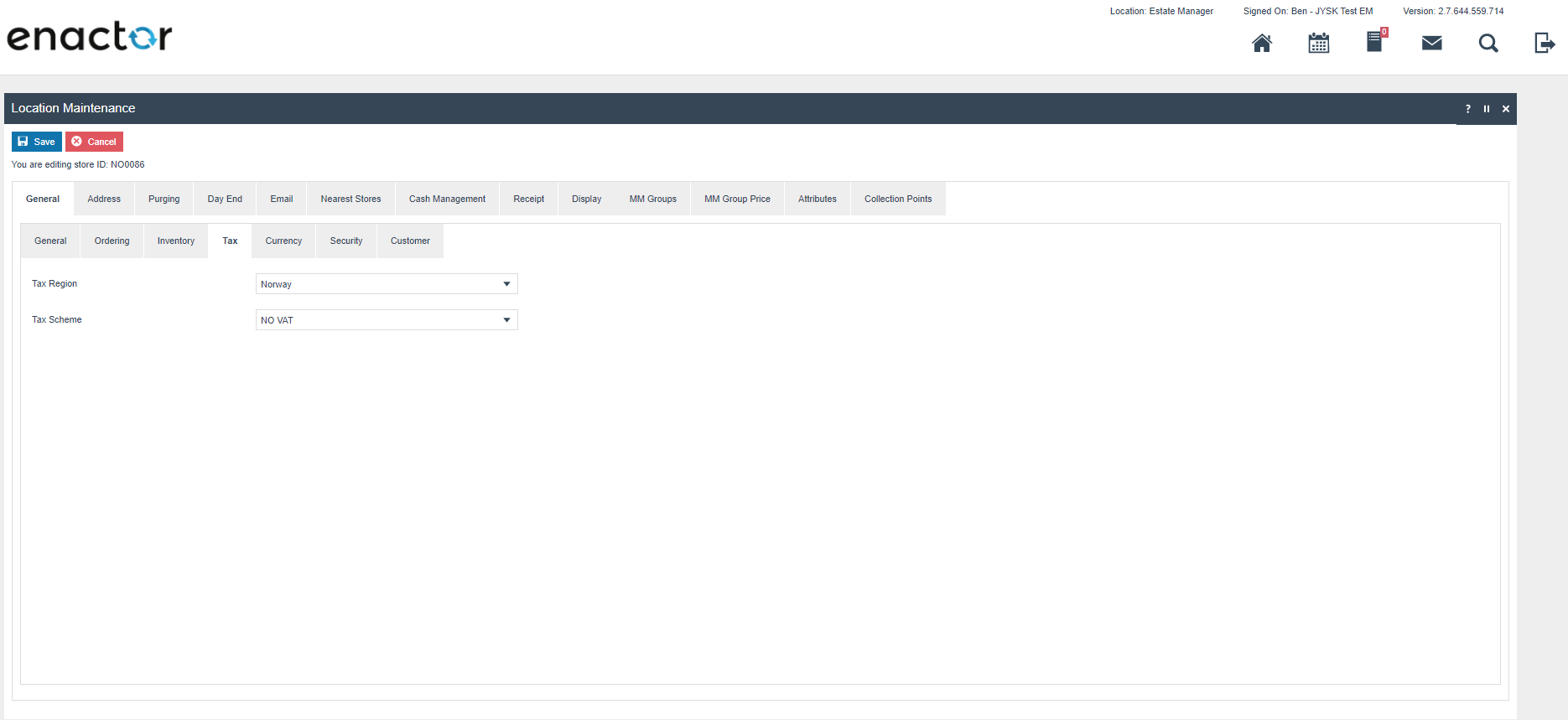

Within the Tax section the Tax region should be set to Norway and the tax scheme to NO VAT

Fiscalisation Type should be set set to Norway

Location

Each location in Norway should have its Tax Region set to Norway and Tax Scheme set to NO VAT, although this should normally be done through the location template.

Account Credentials

It is necessary to import a set of account credentials into the estate manager but this configuration will be provided by Enactor since it contains the pre-encrypted key that is used to sign the transactions. This key is encrypted with a symmetric key and provided by Enactor ahead of time since it is a requirement of the legislation that this key is not disclosed to the retailer to ensure they cannot circumvent the signing process. The symmetric key that is used to encrypt the private key is not disclosed to customers and this protects against any end user obtaining the private key used to sign transactions.

Once the account credential has been imported on the EM it must be broadcast to all of the Norwegian devices.

Privileges

The following privileges will need to be configured and broadcast to the Norwegian devices. Care should be taken to ensure that these privileges are given to the appropriate users of the system to ensure that the functions can be performed at an appropriate time. For instance it is necessary to run a Z report everyday so there should always be a user present in the store at the end of the day with the appropriate privileges to do this.

| Privilege ID | Package |

|---|---|

| Print Fiscal Reports | POS Fiscalisation |

Menus

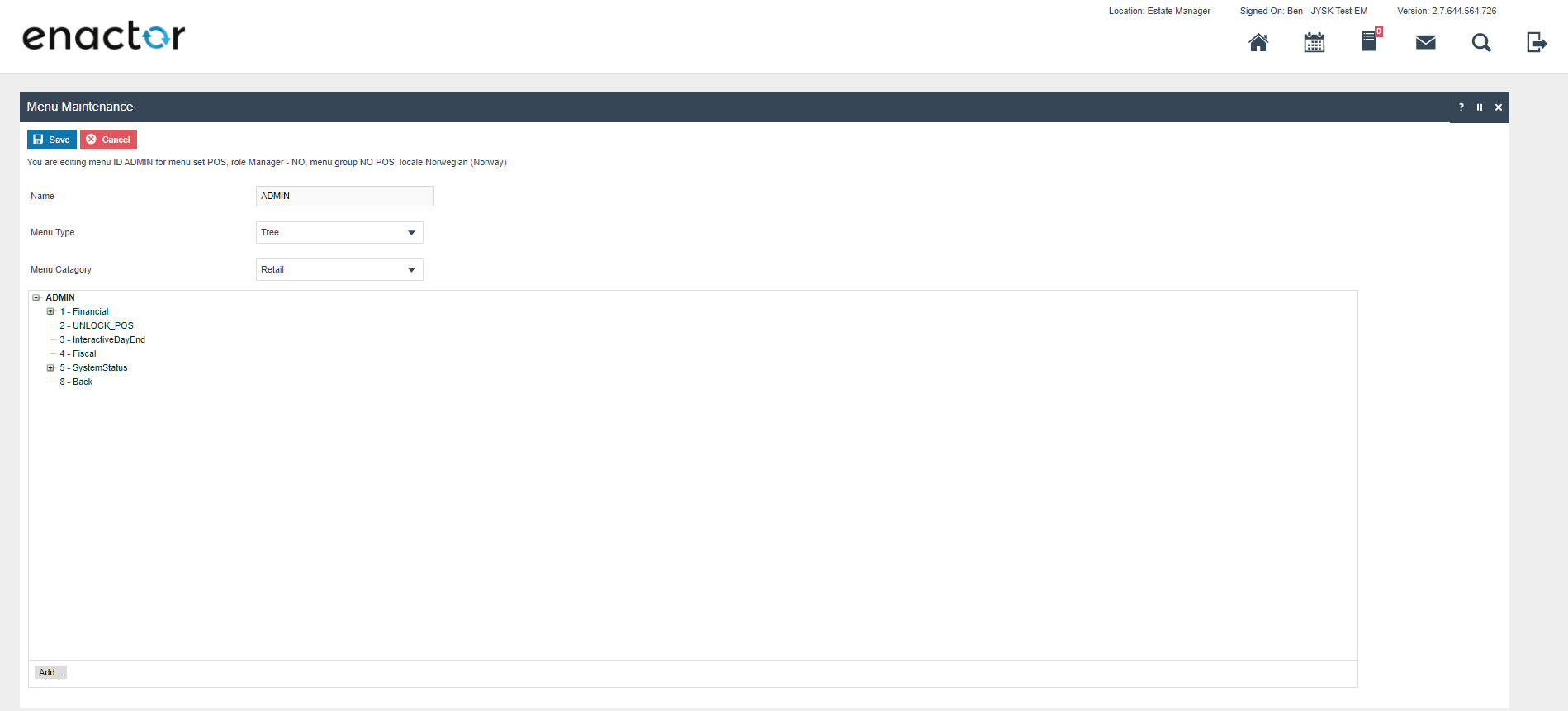

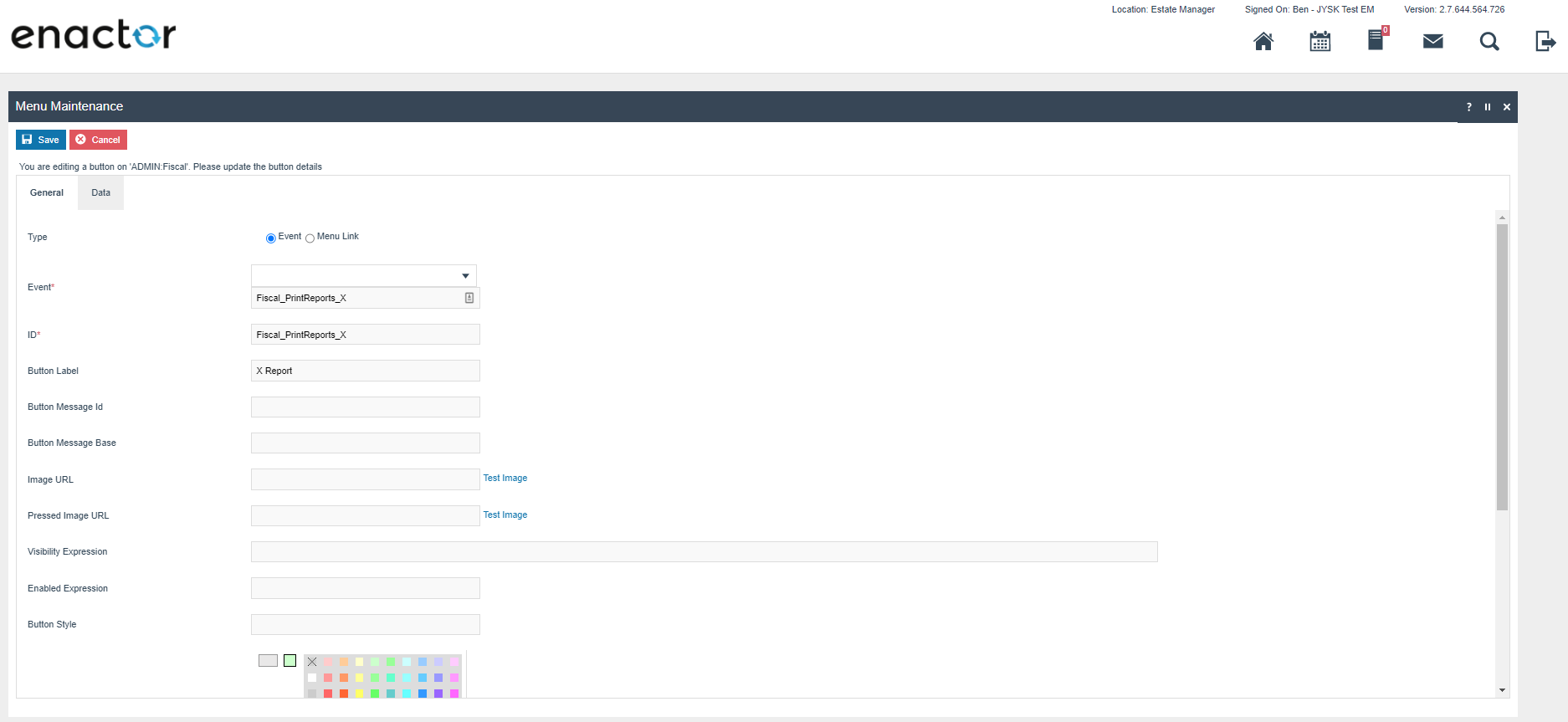

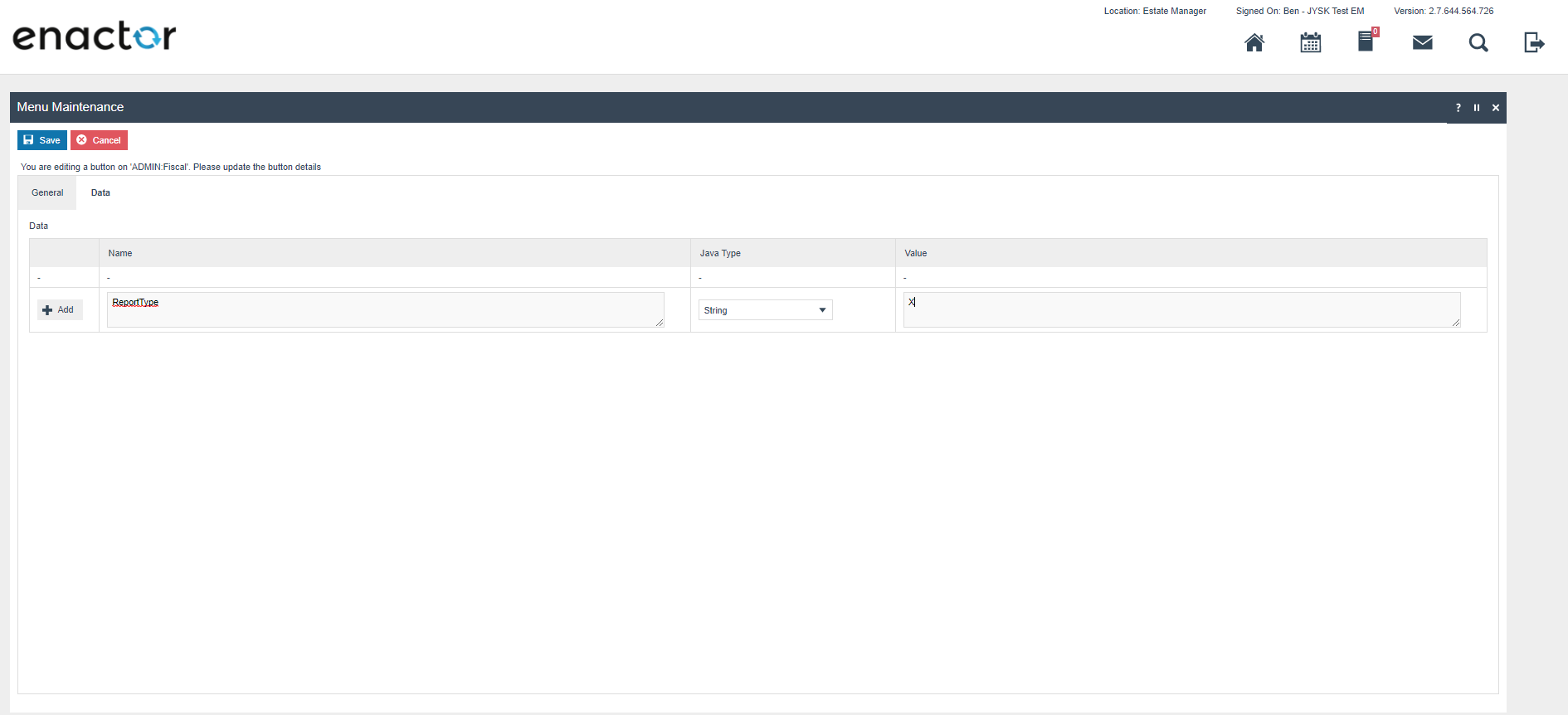

At an appropriate point within the Norwegian POS menu structure, suggested on the Admin menu, a fiscalisation menu with the following items will need to be configured and broadcast to the Norwegian POS devices. This menu will be used for performing X and Z reports. Although access to this report is controlled with the above privilege it may be beneficial to only configure this button on the menu for the appropriate role, i.e. if a manager will perform this function it is only available on the manager menu.

| Event | ID | Button Label | Data Name | Data Java Type | Data Value |

|---|---|---|---|---|---|

| Fiscal_PrintReports_X | Fiscal_PrintReports_X | X Report | ReportType | String | X |

| Fiscal_PrintReports_Z | Fiscal_PrintReports_Z | Z Report | ReportType | String | Z |

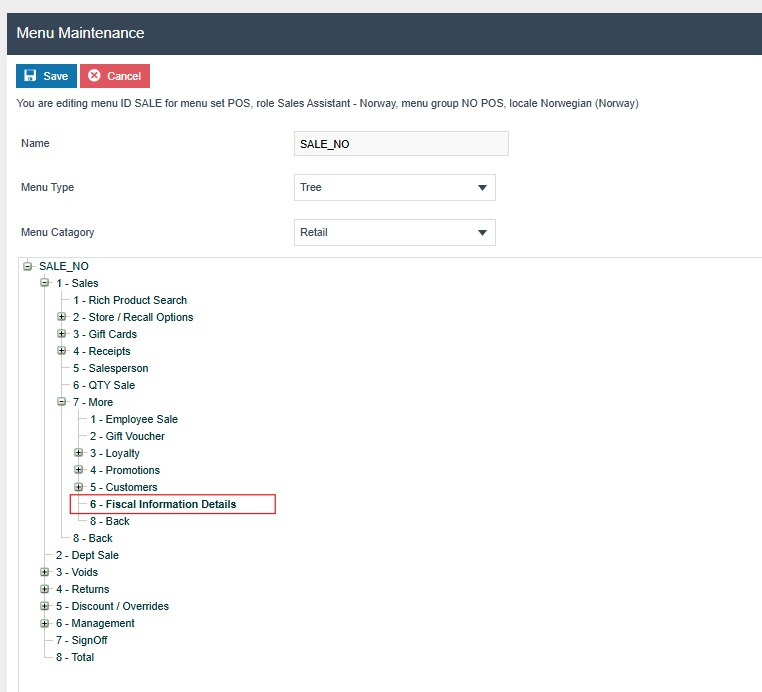

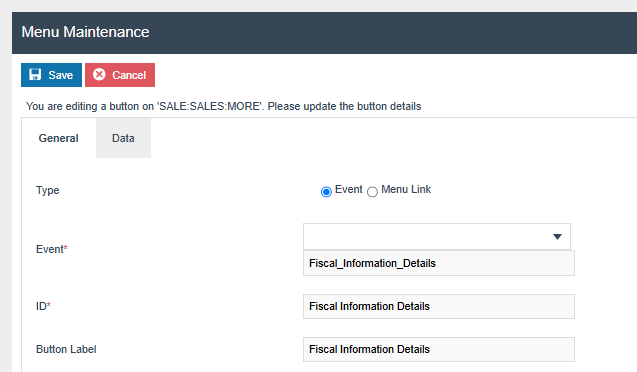

Create a menu button in SALES menu with event “Fiscal_Information_Details”

User Role

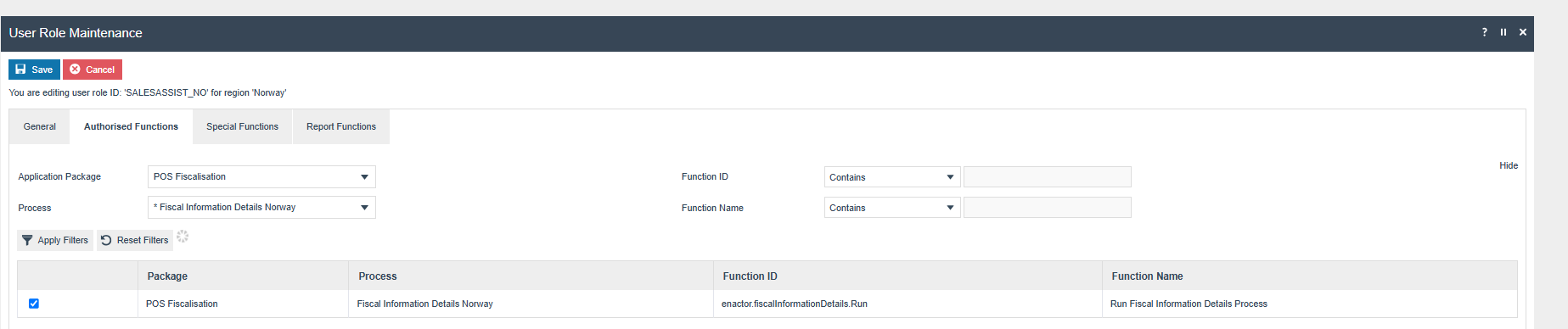

To configure the required settings for the new screen that include fiscalisation type and Fiscal Module Version, select the relevant User Role ID, such as "Sales Assistant." Edit the chosen User Role ID and navigate to the "Authorised Functions" section. From there, select "POS Fiscalisation" as the Application Package from the dropdown menu. Next, choose "Fiscal Information Details Norway" as the Process and enable the "Run Fiscal Information Details Process" option

Product Tax

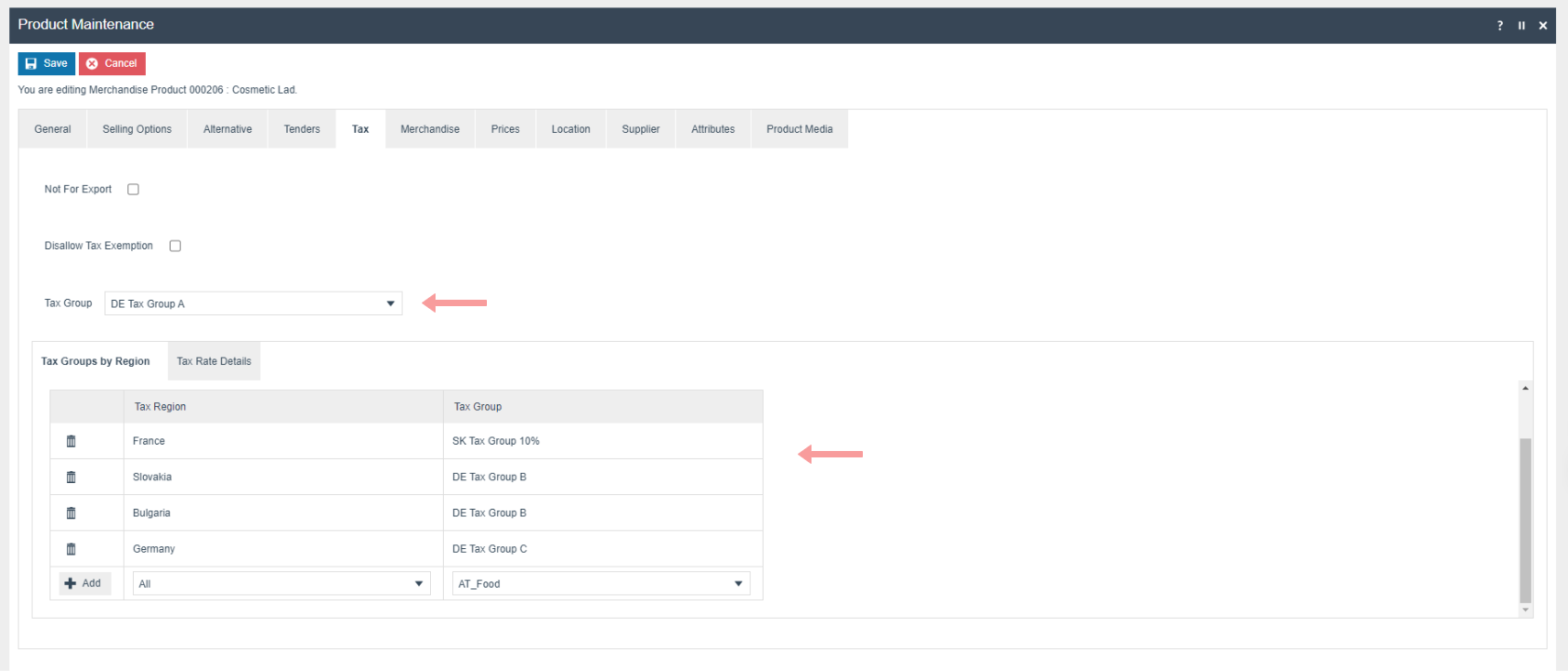

The following tax configurations should be configured against the products and broadcast to the appropriate Norway devices. A tax group can be defined to either configure the tax group or have a tax group by tax region.

MMGroup to Fiscal Product Group Mapping

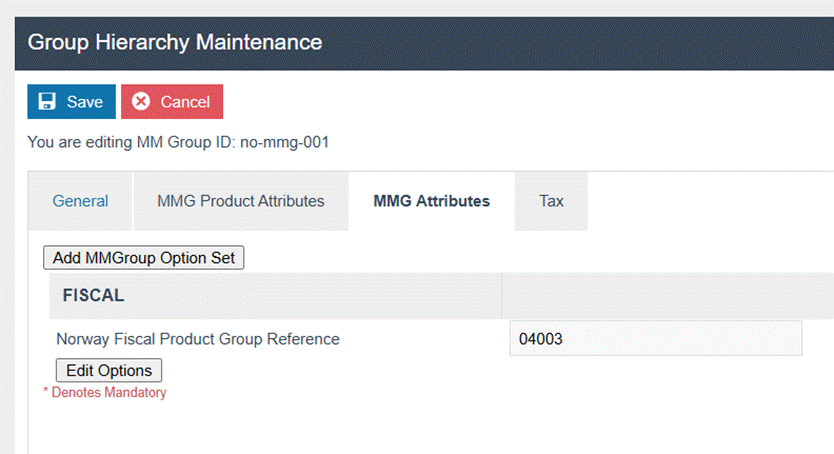

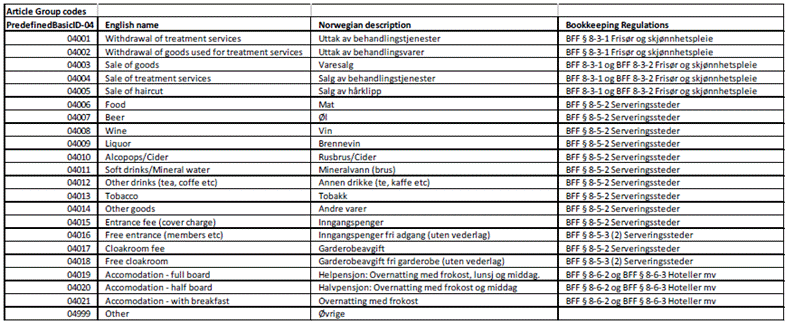

In Norway it is necessary to map products to an Article Group Code provided by the Norwegian Tax Authority. Unfortunately Enactor only supports a single MMGroup Hierarchy so to configure this mapping it is necessary to add an attribute to the MMGroups for products sold in Norway with the mapping the Norwegian Tax Authority.**

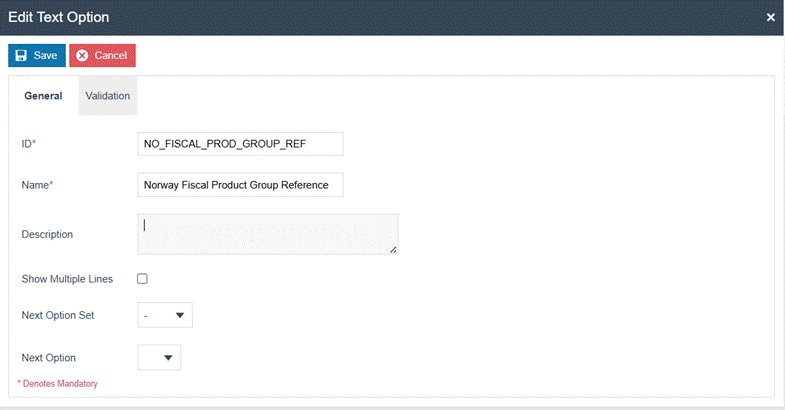

** To map a MM group with a fiscal article group following configuration must be done.

-

Go to Group Maintenance > MM Group

-

Select the particular MM Group

-

Navigate To MM Group Attributes Tab

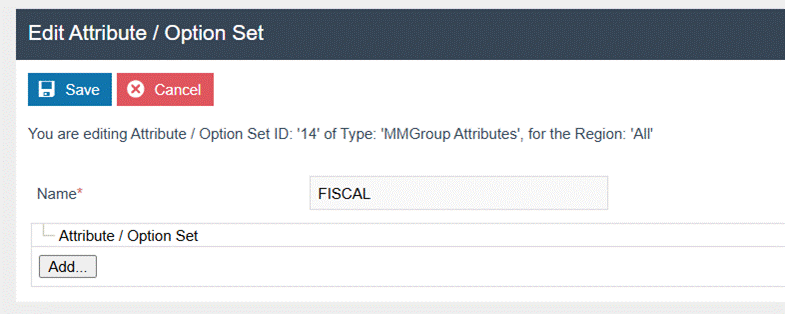

-

Create an Attribute / Option Set as follows

- Set ID - FISCAL

-

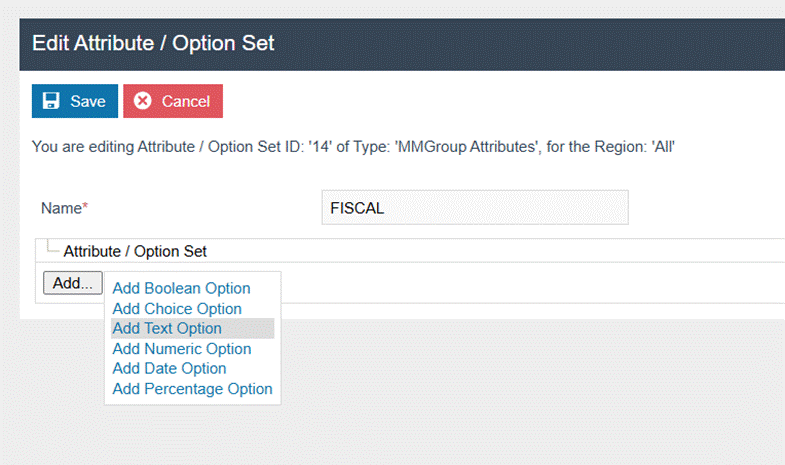

Add new text attribute as follows

-

ID - NO_FISCAL_PROD_GROUP_REF

-

Name - Norway Fiscal Product Group Reference

-

-

Save that attribute.

-

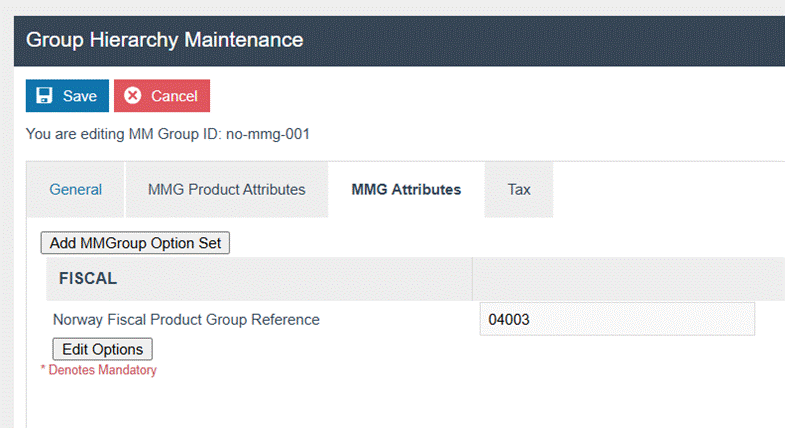

Then go back to the MMG Attributes tab.

-

Add the relevant fiscal article group reference value here according

to the Norway bookkeeping regulations.

Note: it is possible to provide this config for a parent element in the hierarchy Tax Authority Article Group Code will be applied to all of its children.

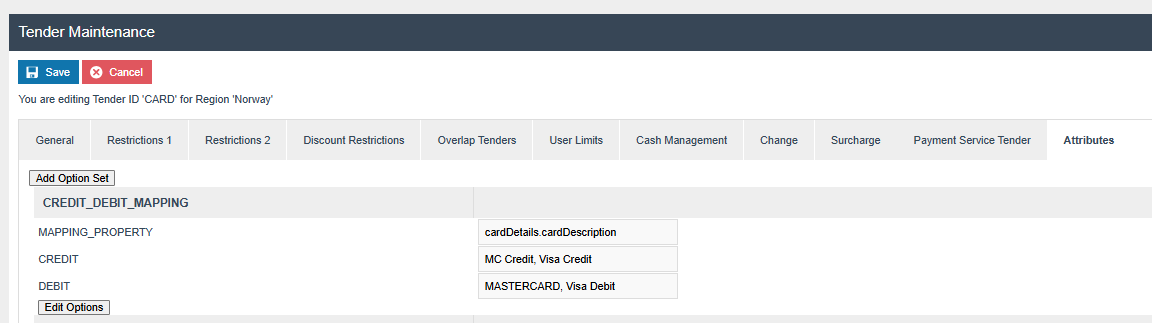

Payment Service CREDIT_DEBIT Mapping

-

Navigate to Attribute / Option Set Maintenance

-

Click **Create a new Option Set

**Attribute / Option Set - **CREDIT_DEBIT_MAPPING

**Type - **Tender Attributes

**Region -**Norway/>

** -

Click Add under the created Attribute/Option Set

-

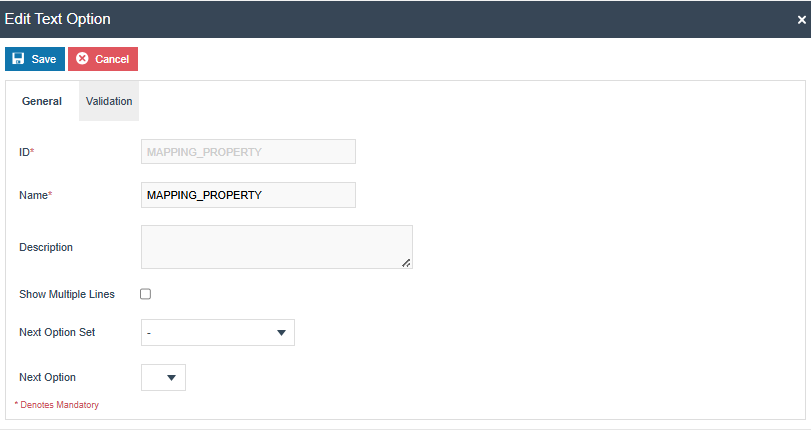

Select Add Text Option

-

Create 3 Text Attributes:

Mapping Property

ID - **MAPPING_PROPERTY

** Validation - **Strings

** Allow blank - Enable

Credit

ID - **CREDIT

** Validation - **Strings

** Allow blank - Enable

Debit

ID - **DEBIT

** Validation - **Strings

** Allow blank - Enable

-

Navigate to Tender Maintenance

-

Edit Tender ID related to Card (Payment Service) Tender

-

Navigate to Attributes

-

Add values to attributes as follows,**

** MAPPING_PROPERTY - cardDetails.cardDescription

CREDIT - MC Credit, Visa Credit

DEBIT - MASTERCARD, Visa Debit

Note: Set MAPPING_PROPERTY the same as mentioned above. Add keywords for CREDIT and DEBIT, separating each keyword with a comma. Also, obtain the possible card description values for Credit and Debit cards from the payment service provider.

Norway Specific Functions

The operation of both the POS and the Estate Manager is for the most part the same as any other county when the Norwegian fiscal module is being used. This guide does not intend to cover the full operation of the POS instead the Enactor Books should be referred to at https://insights.enactor.co/

Instead this guide will cover any Norwegian specific operations as well as considerations that should be taken with regard to maintaining a compliant solution in Norway.

Z Report

The configuration guide above detailed the set up for a menu from which to trigger the Z report as well as a set of permissions to enable a member of store staff to trigger this report on the POS. Staff should be trained to run this report every day and retain the printed Z report that it will produce in accordance with the fiscal regulations. Running the Z report closes the fiscal day and will contain adjusted grand totals to account for that day's trade.

X Report

The X report is configured and runs in the same way as the Z report. However its operation is different; it is a purely informational report and does not close the day or affect grand totals, although the data it contains is very similar to the Z report. It's not necessary to run the X report but it is provided to allow a member of staff to see what the Z report position would be at present if the day were closed by running the Z report.

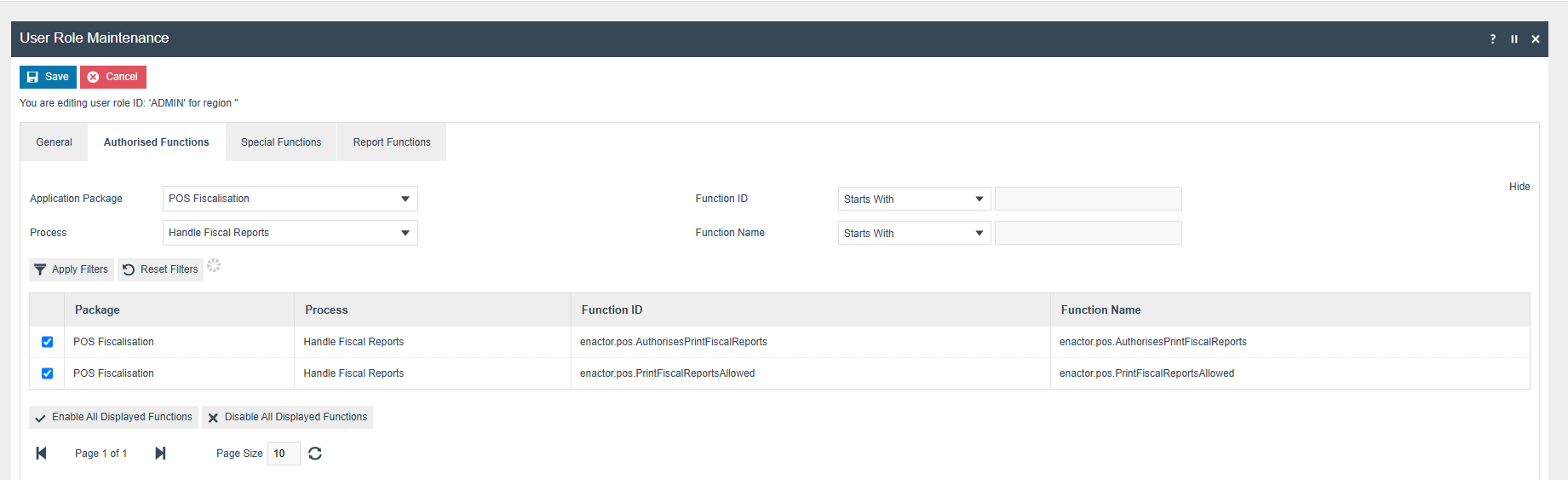

Enabling X/Z Report Printing

Both X/Z report printing functionalities are now privilege-controlled. To print X/Z reports, you must first enable the following privileges:

- enactor.pos.AuthorisesPrintFiscalReports

- enactor.pos.PrintFiscalReportsAllowed

Unless these privileges are enabled, printing X/Z reports will not be allowed.

To configure this, go to User Role Maintenance in the Enactor Manager (EM). Based on your Role ID, navigate to the Authorised Functions tab, select Pos Fiscalisation as the Application Package, and set the Function ID to enactor.pos.AuthorisesPrintFiscalReports. Then enable the function.

Repeat the same steps for enactor.pos.PrintFiscalReportsAllowed.

Once these privileges are enabled for the relevant roles, X/Z report printing will be permitted.

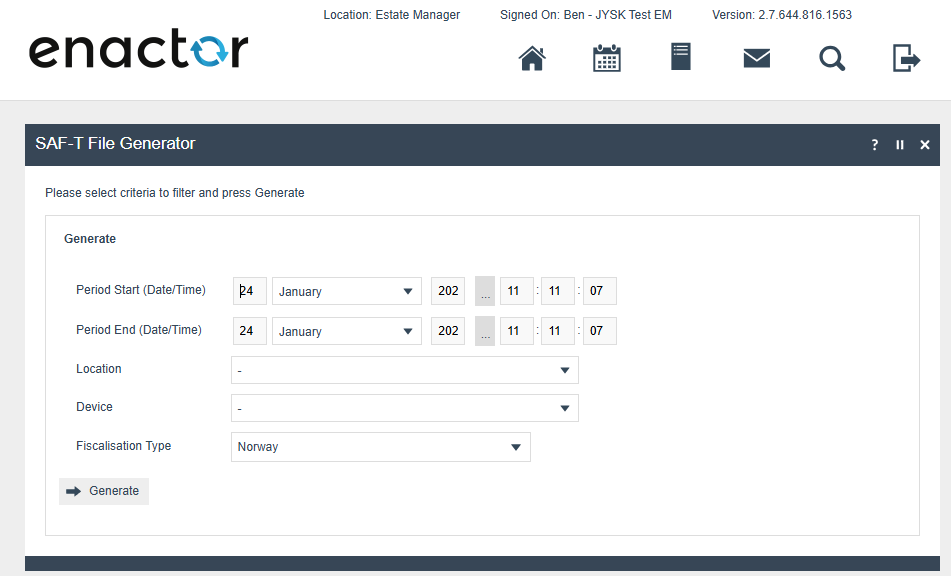

SAF-T File Export

From the estate manager it is possible to trigger the production of a SAF-T file. This should only be required if requested by the Tax Authorities at the time of an Audit. However, it would be pragmatic to produce this report on a regular schedule to maintain a second record of transactions along with the database and its backups in the event of a total loss of the enactor database and its backups also failing.

First select The “SAF-T Generator” report from reports > Fiscal.

Populate the required data ranges location and device from the screen shown below and click generate.

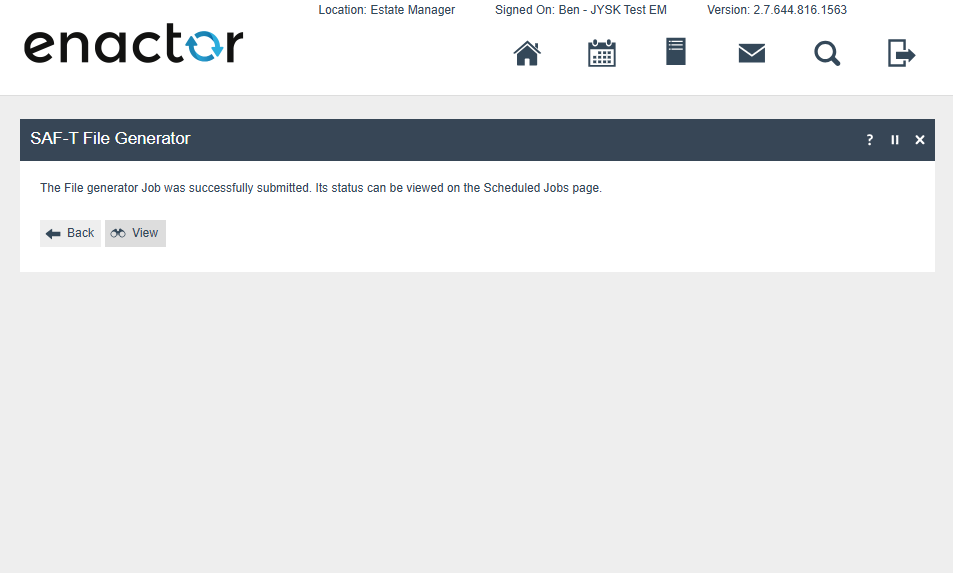

This will trigger a scheduled job in the background which can be monitored from the scheduled jobs page as usual. Once the job has completed it will be possible to download the generated xml file from file downloads on the EM.

Note:

Generated SAF-T files cannot be found in "/FiscalData/Norway/SAF-T" folder as earlier. They are currently available in the following location.

/var/lib/docker/volumes/enactor-data-emp-home/_data/Exports/<USER>/<yyyymmdd>

Fiscal Tables

Estate Manager

It’s important that all data contained in the EM is backed up in a manner that ensures data will not be lost in the event of a disk or server failure. Strategies for doing this vary and each retailer will have their own approach depending on their particular situation. However, the following list of tables comprises the fiscal archive, it is critical that data contained in these tables is not removed either intentionally or otherwise before the mandated retention period for transaction data is over as this will result in invalid SAF-T files with signature chains that have breaks within them.

-

Fiscal Transactions

-

Retail Transaction Archive

-

Products

-

Product Groups

-

Location

POS/PDP

Data held on the POS/PDP is less critical than the estate manager since the fiscal data store is the Estate Manager and the data about transactions held on the POS is temporary. However one special consideration needs to be given when recovering from a disaster on a POS or PDP server since the signature for each transaction contains the signature of the prior transaction as part of the data that is signed.

The normal DR process for a POS or a PDP is to just rebuild and install it and then schedule a broadcast of the required configuration from the EM to the new device. Commonly the same device ID is used for the new device even in the event of total hardware failure since retailers like to keep consistency in their POS naming conventions. If this process is followed in Norway without adaptation this will result in a new signature chain being started for that POS which will appear in a SAF-T audit as a break in the signature chain for the device.

Instead when recovering from a POS or PDP disaster in Norway an extra step is required to discover the last signature the failed device produced. This signature will then need to be reseeded to the new POS. In the case of a PDP it will be necessary to reseed the signature of each device hosted by the PDP.

This is an advanced and extraordinary procedure, the first time you perform this you should contact support@enactor.zendesk.com to arrange for a member of the fiscal team to walk through the procedure with you. The following instructions are not intended to be sufficient for you to perform this procedure without help, for this reason.

First check on the estate manager that there are no inbound documents waiting to be processed from the failed device. It will then be necessary to find within the EM SQL database the last transaction, processed from the failed device, in the Fiscal Transactions table and extract the signature from the xml column. After building the new POS but before logging in it will be necessary to populate this value to the appropriate table on the POS.