How To Guide Fiscal Slovakia

Fiscal Overview

For shared background, see Fiscal Overview.

Slovakia Fiscalisation Introduction

In Slovakia, POS fiscalisation is a legal requirement for businesses to ensure accurate and transparent financial reporting.

It's important for businesses in Slovakia to select a certified fiscal solution and ensure proper installation and configuration of the system to meet fiscalisation requirements. Failure to comply with POS fiscalisation regulations can result in penalties, fines, or legal consequences.

Overall, POS fiscalisation in Slovakia aims to enhance transparency, combat tax evasion, and streamline the process of tax collection by leveraging electronic recording and reporting of sales transactions.

Deployment Overview

-

Initiate the ‘application updater update.zip’ file first.

-

Wait until it succeeds.

-

Then send the ‘update PDP min.zip’ file.

-

Wait until it succeeds.

-

Then send the ‘update Fiscal Module.zip’ file.

-

Wait until it succeeds

-

Finally send the Printer resources-Slovakia.zip

-

Once it is succeeded, the PDP is ready with the new Fiscal Module.

-

After the successful deployment following JARs should be updated in

the Enactor -> PDP Server -> ext-lib folder.

-

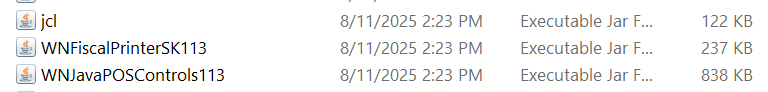

Remove the following jar files from Enactor -> PDP Server ->

ext-lib folder.

-

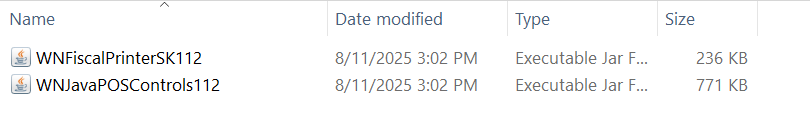

Unzip the “PrinterResources_Manual.zip” file and copy the jar files

inside it to Enactor -> PDP Server -> ext-lib folder.

-

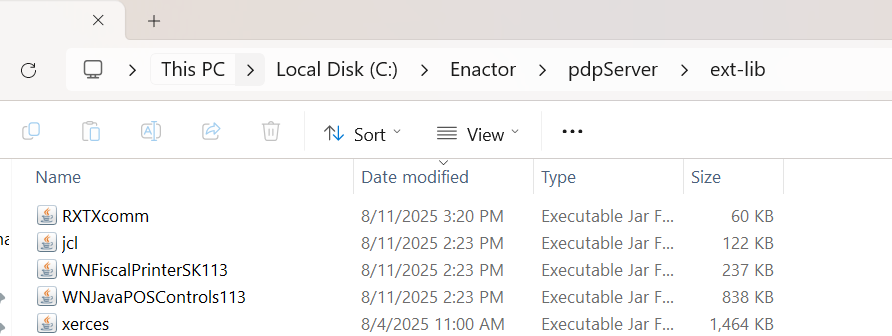

The following files should be available in the ext-lib folder now.

-

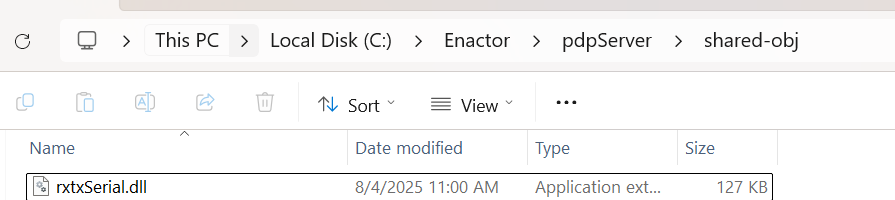

Copy the “rxtxSerial.dll” file inside the “PrinterResources_Manual

into Enactor -> PDP Server -> shared-obj folder.

-

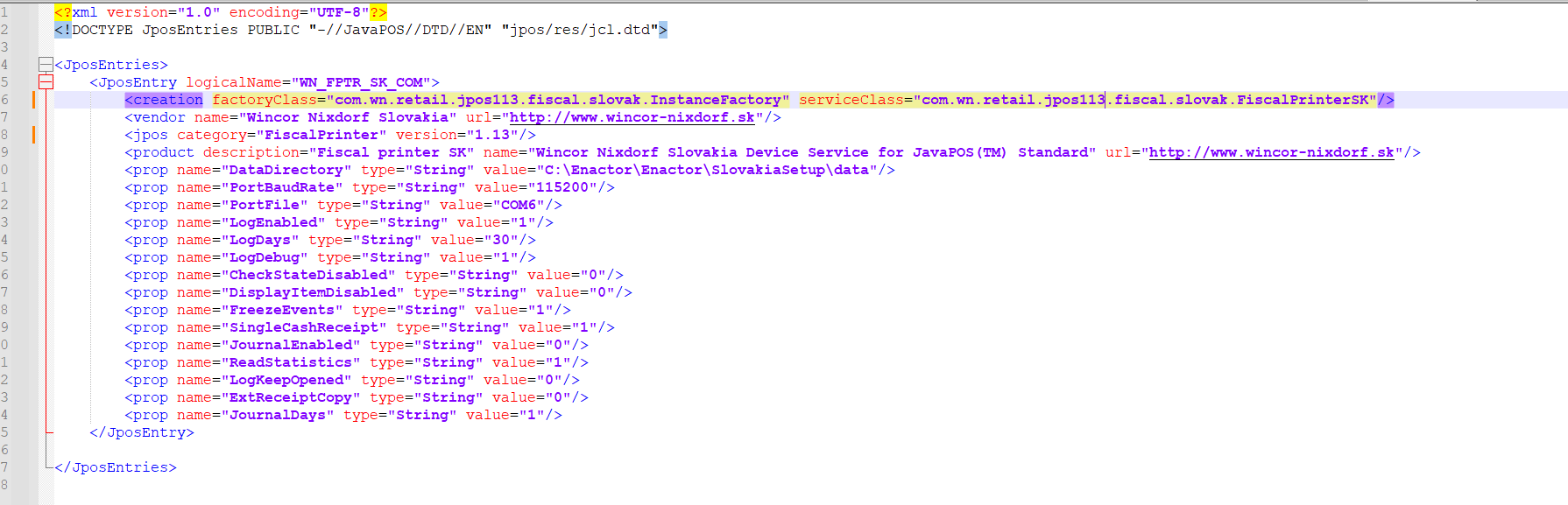

Edit the jpos.xml in the Enactor -> PDP Server -> config folder.

-

Update the fiscal printer versions from 1.12 to 1.13 as displayed in

the sample below.

-

Make sure the factoryClass and serviceClass properties has correct

JPOS library version. (jpos113)

-

Update the “PortFile” property value into the correct com port

according to the printer com port you are using.

Configuration Overview

The following configuration changes are required and must be broadcasted to all Slovakia devices in preparation for go live. Detailed steps for how to do this are contained in supplementary How to Guides available on the Enactor Insights portal, as well as being covered in the Introduction to Enactor training course. Although steps have been taken to ensure that the POS will not start or perform transactions without a valid configuration it is the retailers responsibility to ensure a valid configuration is present and not to try to circumnavigate any of the requirements of the Slovakia Fiscal Legislation through misconfiguration of the solution.

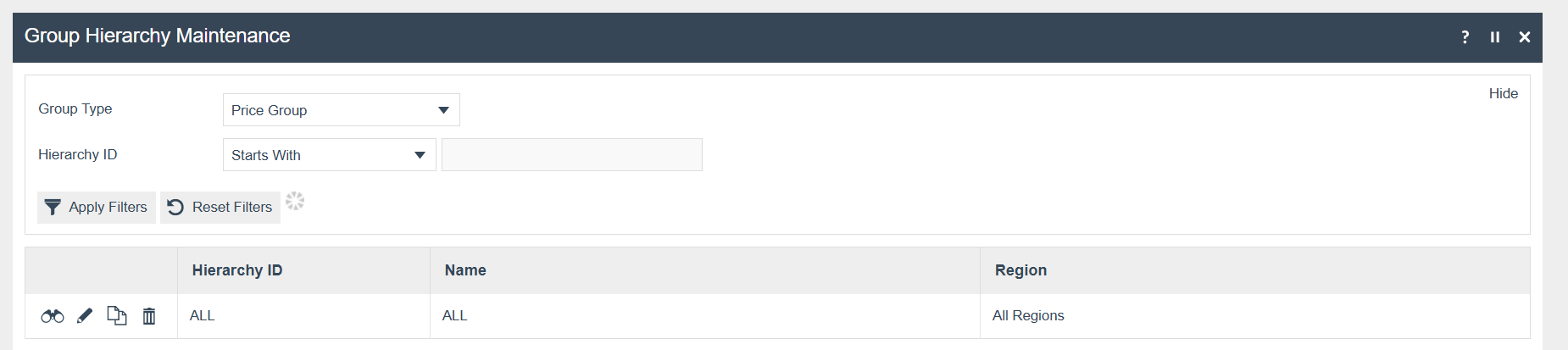

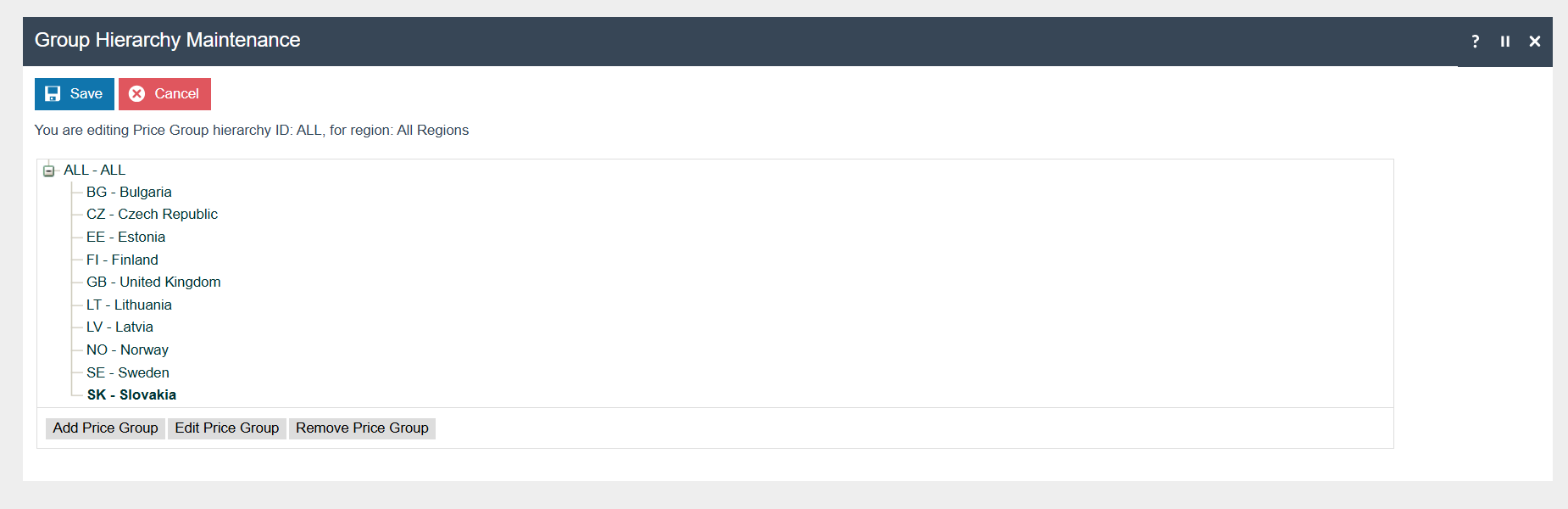

Group

Create a new Region group, Tax Region and Price group for Slovakia as below.

| Group Type | Group ID | Group Name |

|---|---|---|

| Region | SK | Slovakia |

| Tax Region | SK | Slovakia |

| Price | SK | Slovakia |

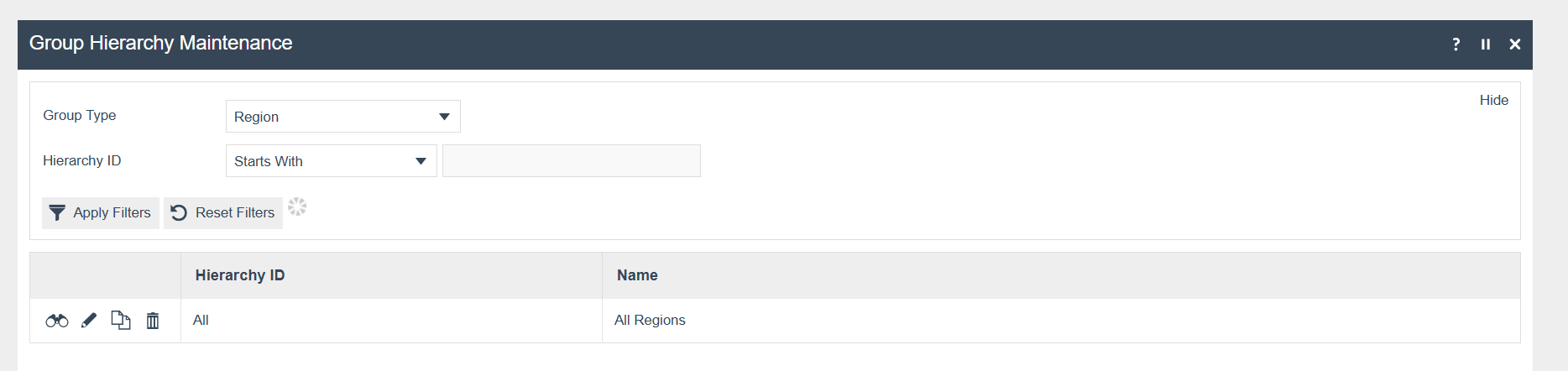

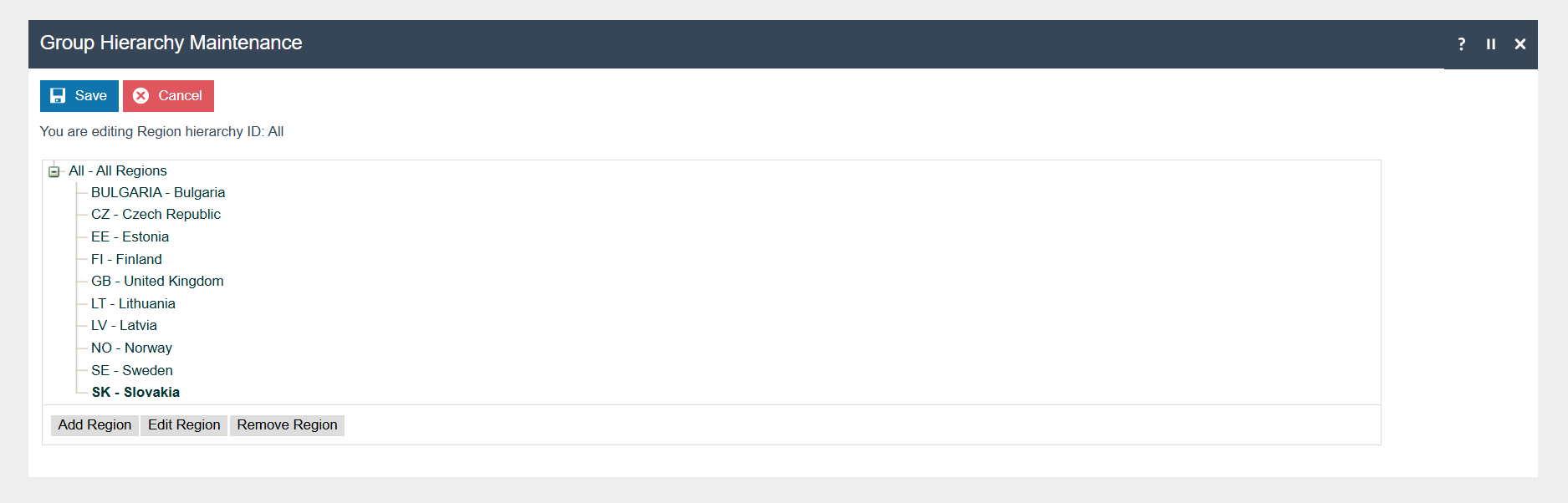

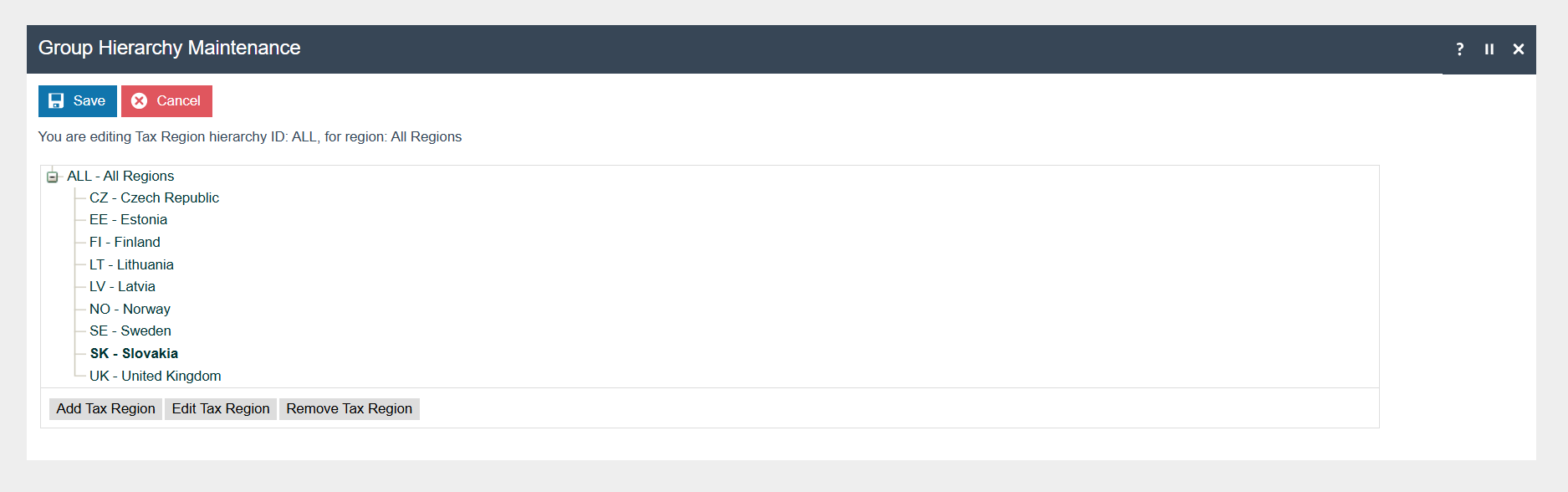

Region Group

The region must be configured to continue the other configurations related to the fiscalisation. The region for Slovakia should be created within the Region Group Hierarchy.

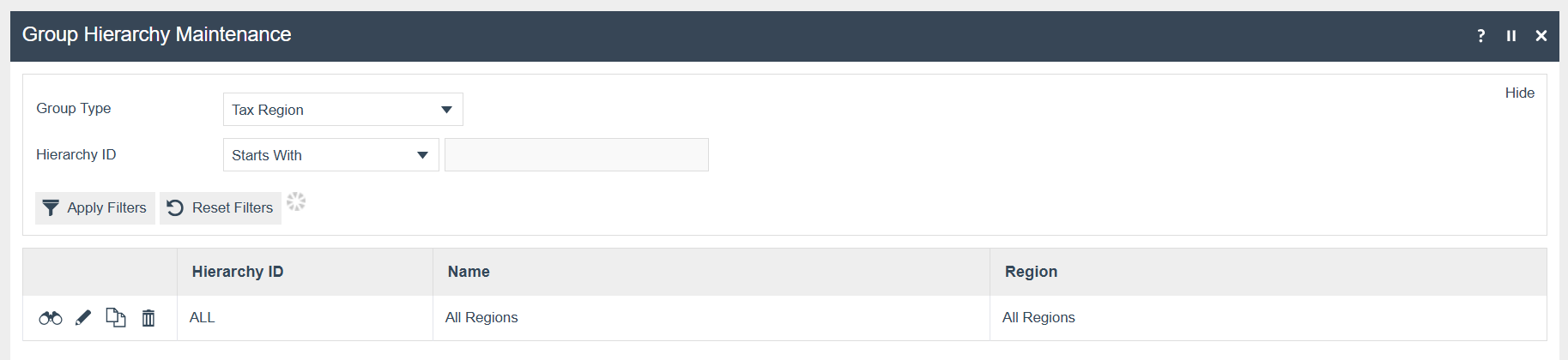

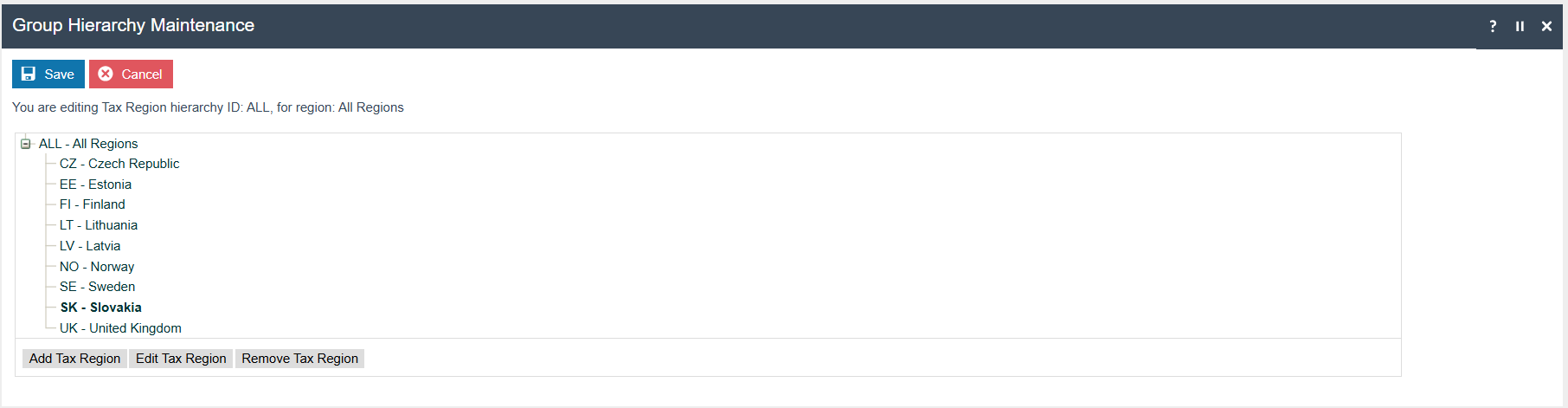

Tax Region Group

Price Group

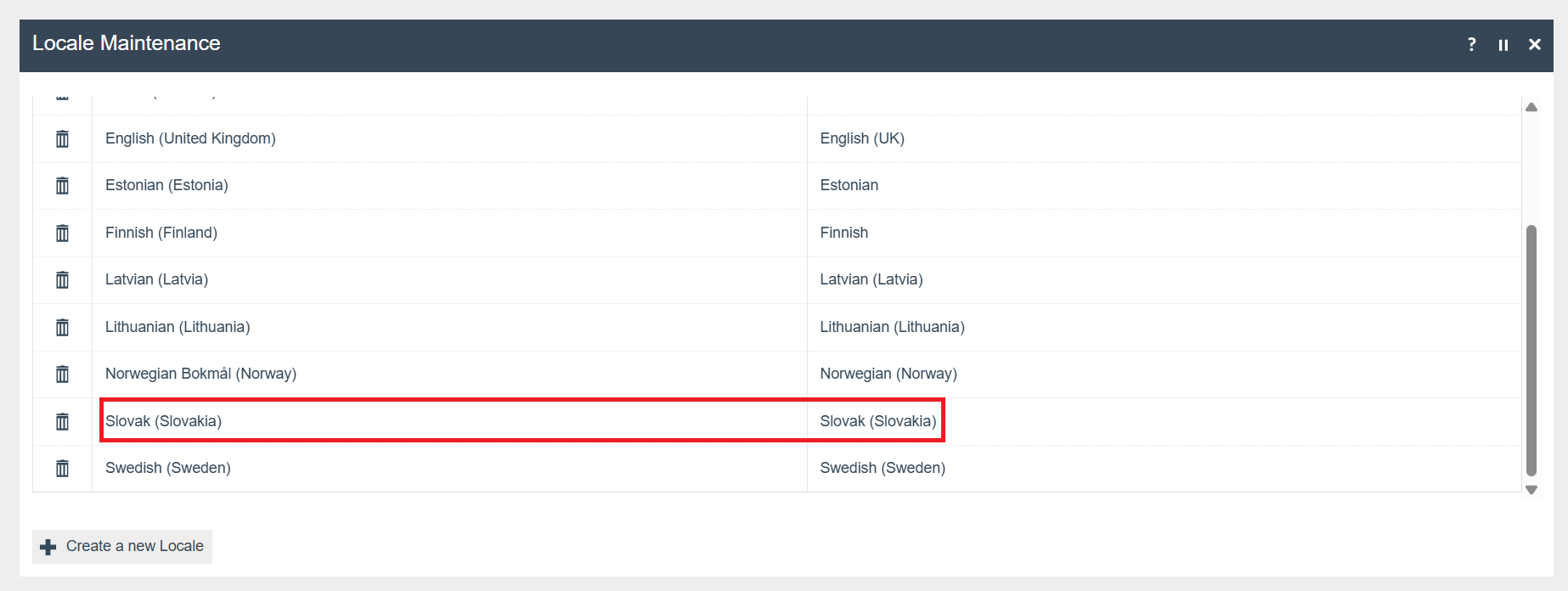

Locale

The following Locale should be configured and broadcast to the appropriate Slovakia devices.

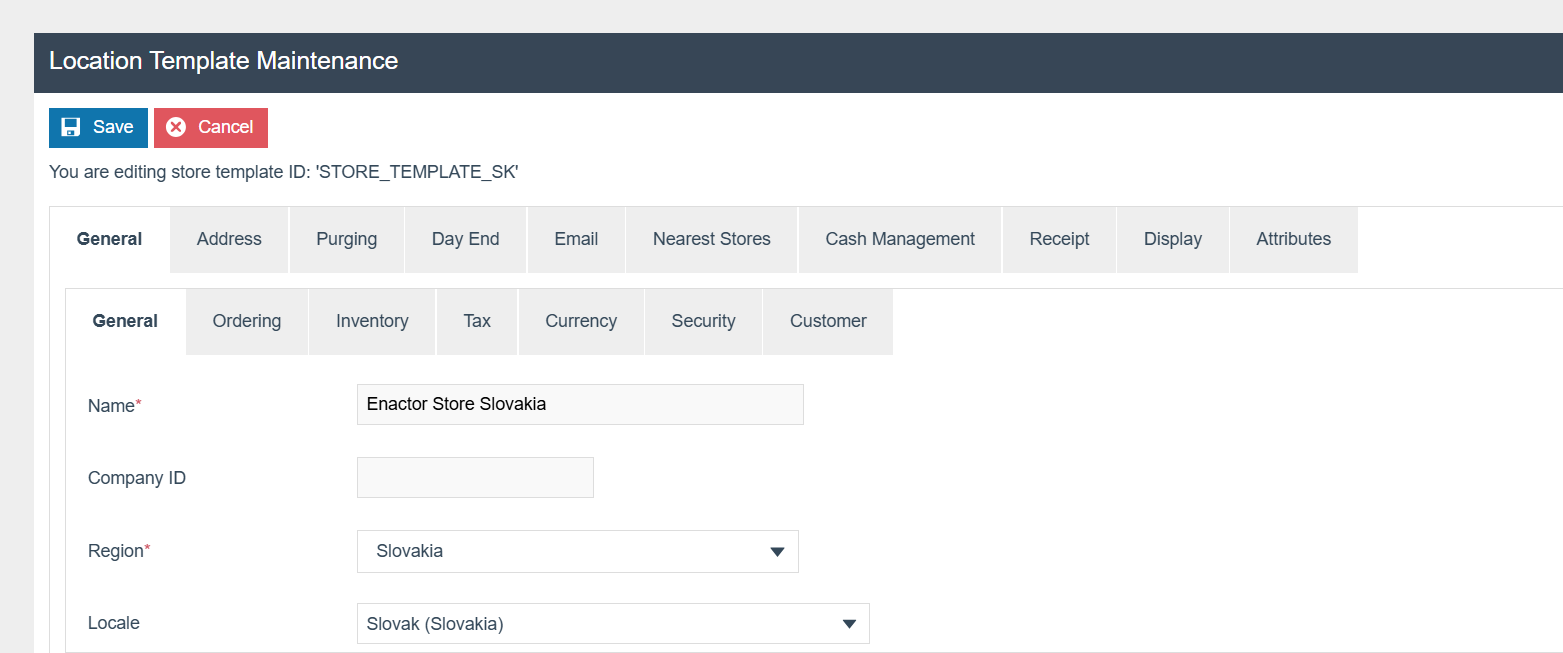

Location

The following Location should be configured and broadcast to the appropriate Slovakia devices.

| Location ID | Name | Region | Base Currency |

|---|---|---|---|

| SK0001 | Enactor Store Slovakia | Slovakia | Euros |

Tax Groups

The following are sample tax rates. Follow this structure for the tax configurations.

| Tax Group ID | Description |

|---|---|

| SK1 | SK Standard VAT 23% |

| SK2 | SK Reduced Rate 10% |

| SK3 | SK Zero Rate 0% |

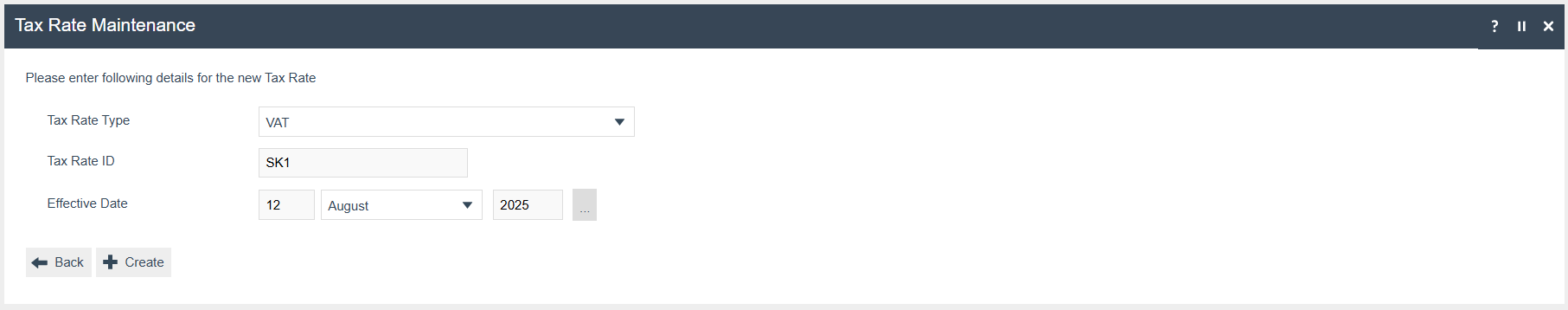

Tax Rates

The following tax rates should be configured and broadcast to the appropriate Slovakia devices.

| Tax Rate ID | Description | Display Code | Percentage | Fiscal Tax Rate Reference | |

|---|---|---|---|---|---|

| SK1 | SK Tax Rate 23% | A | 23% | 1 | |

| SK2 | SK Tax Rate 10% | B | 10% | 2 | |

| SK3 | SK Tax Rate Zero | C | 0% | 3 |

Select VAT as Tax Rate Type

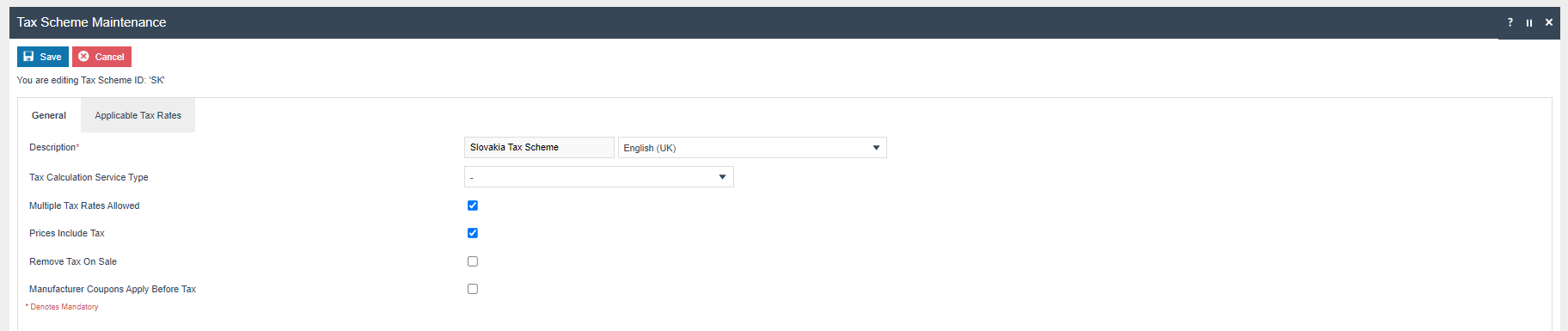

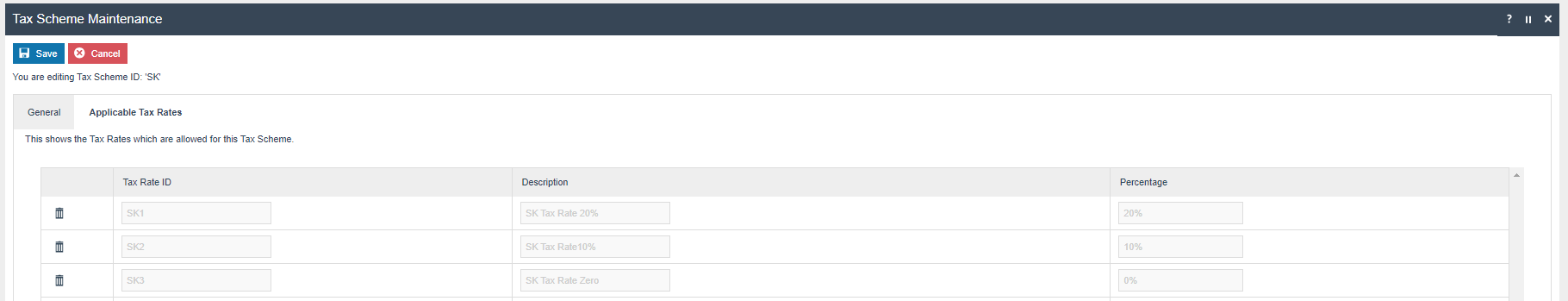

Tax Scheme

Create a new Tax Schema with the following details. Add all the above-mentioned tax rates inside the Applicable Tax rates.

| Tax Scheme ID | Description | Price Include Tax |

|---|---|---|

| SK | Slovakia Tax Scheme | TRUE |

Tax Region

If it does not already exist, a Tax Region for Slovakia should be created within the Tax Region Group Hierarchy. It should have the ID: “SK” and the Name: “Slovakia”, it is not necessary to configure an External Reference ID.

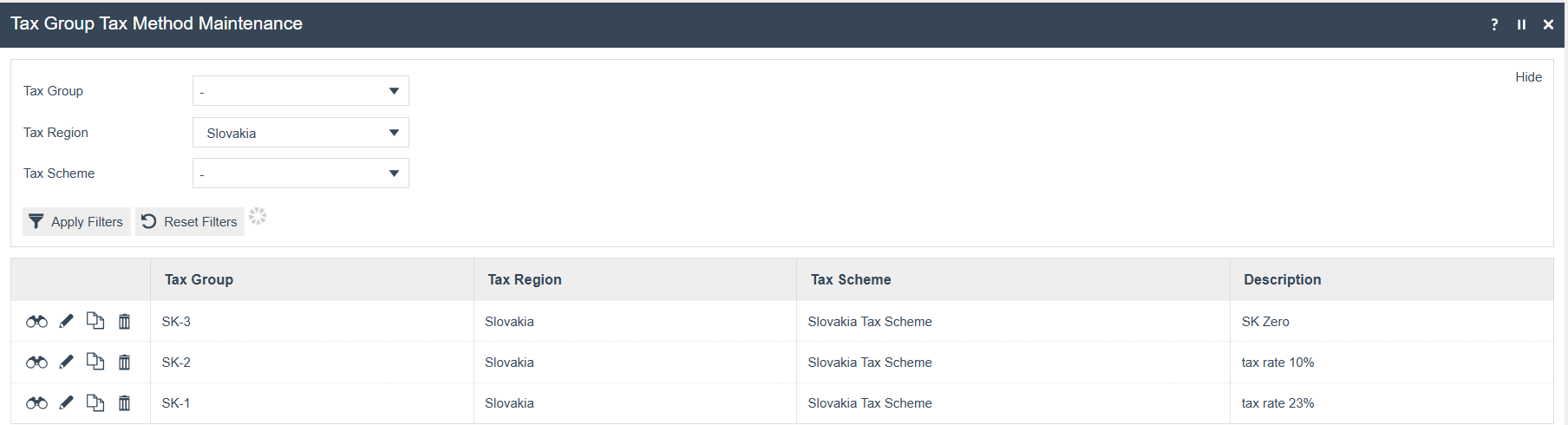

Tax Group Tax Methods

The following tax group tax methods should be configured and broadcast to the appropriate Slovakia devices.

| Tax Group | Tax Scheme | Description | Tax Rate |

|---|---|---|---|

| SK Standard VAT 23% | Slovakia Tax Scheme | tax rate 23% | SK Tax Rate 23% |

| SK Reduced Rate 10% | Slovakia Tax Scheme | tax rate 10% | SK Tax Rate10% |

| SK Zero Rate 0% | Slovakia Tax Scheme | SK Zero | SK Tax Rate Zero |

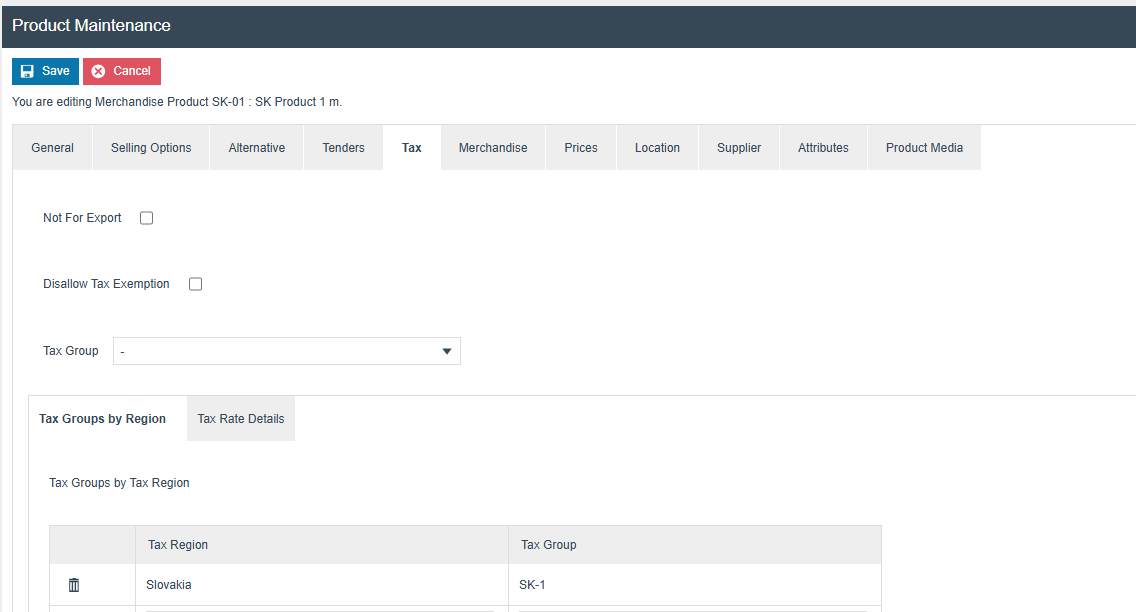

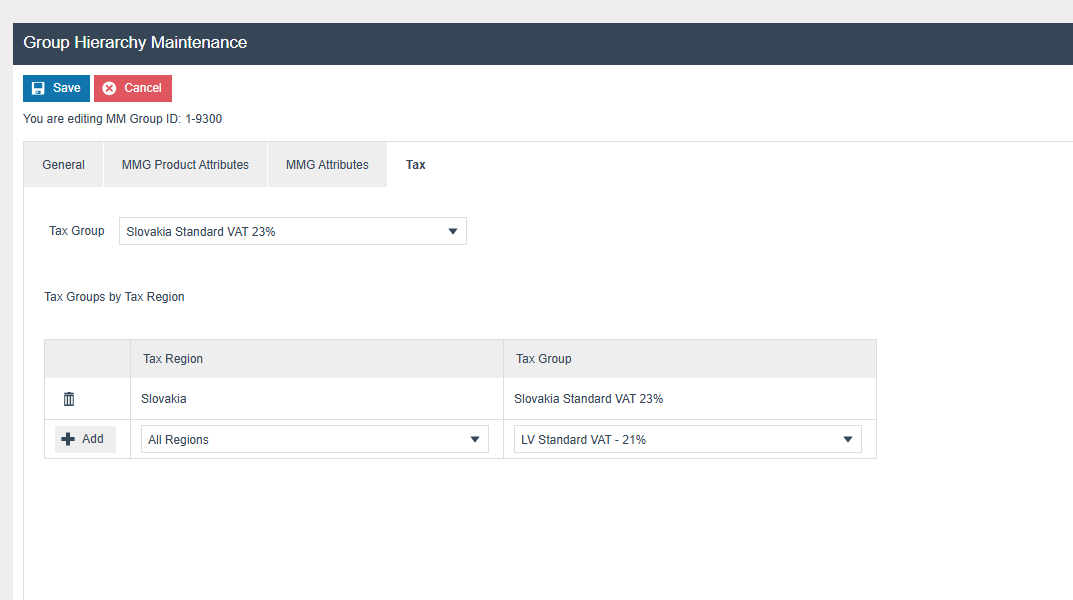

Product Tax

The following tax configurations should be configured against the products and broadcast to the appropriate Slovakia devices.A tax group can be defined either to configure the tax group itself, associate it with a tax region, or configure only tax rate details

Unknown Product Tax Configuration:

- Unknown products must be assigned to a mm group with configured tax

rates

-

Cannot sell unknown products through mm groups without tax

configuration

-

Requires privilege: enactor.pos.AllowUnknownProductSale

Device

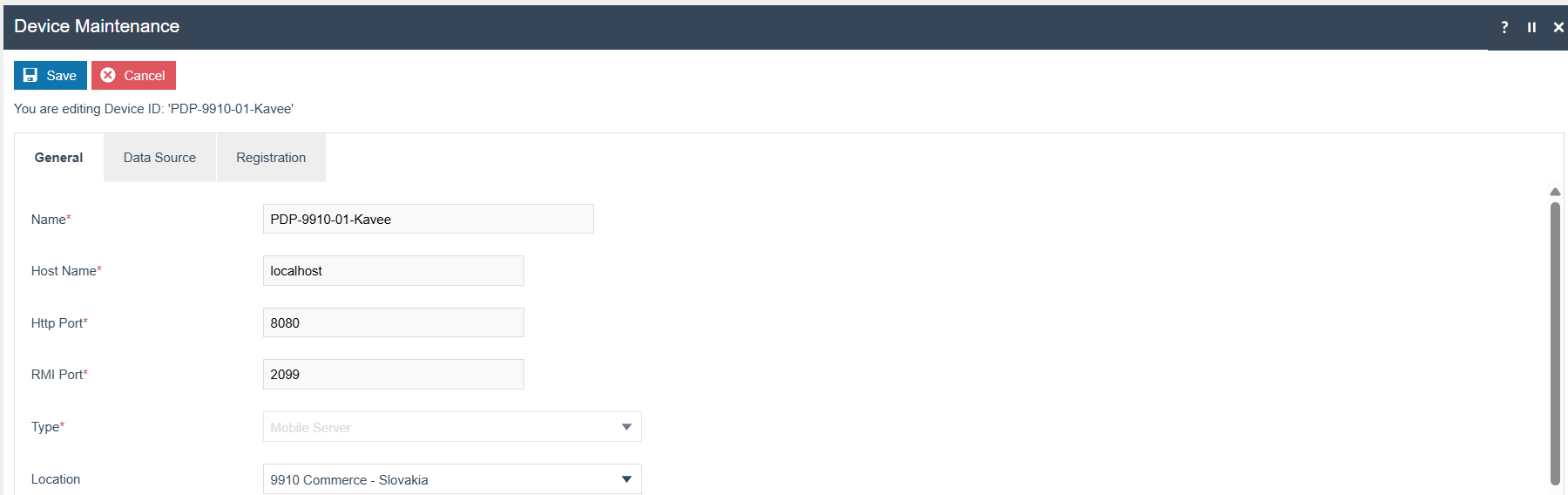

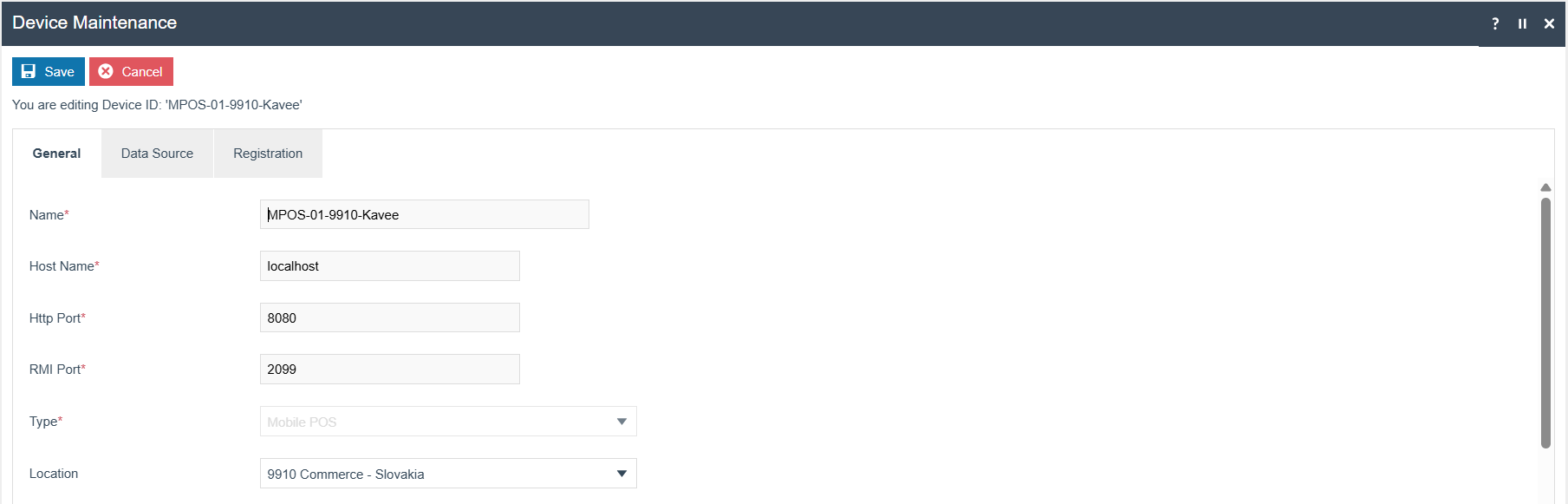

The following Devices for PDP Server and Mobile POS should be configured and broadcast to the appropriate Slovakia devices.

Select the Device type as Mobile Server

Select Device type as Mobile POS

For more detail on device creation refer to the How-To Guide Configuring A New Store

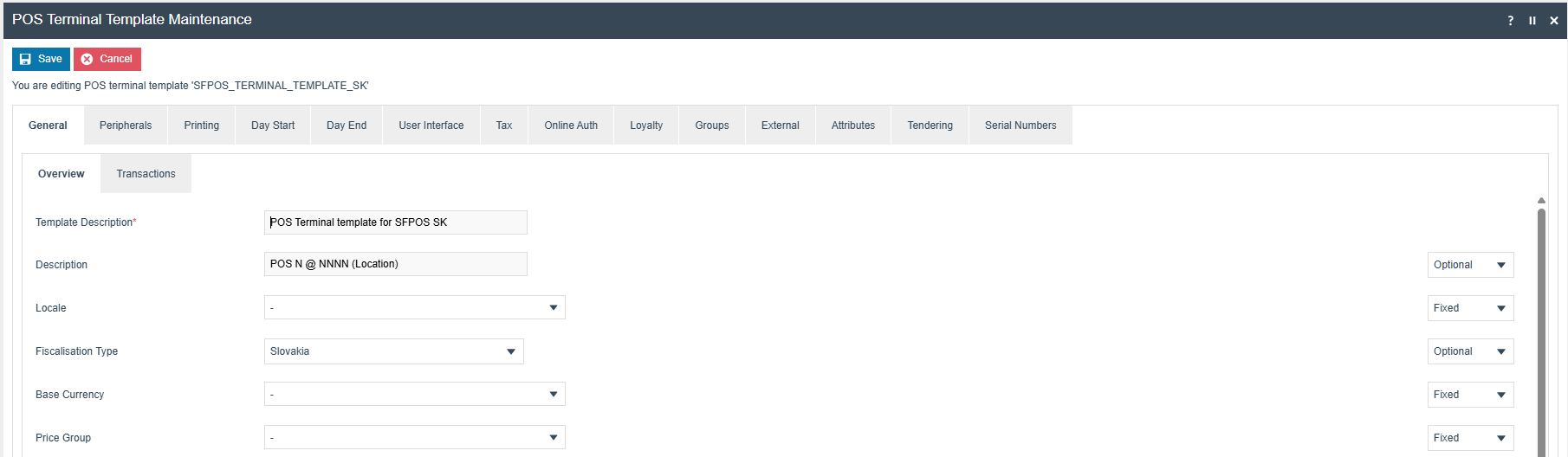

POS Terminal Template

The POS Terminal Template used by all devices in Slovakia must be configured to have the fiscalisation Type set to Slovakia.

Currency should be set to Euro and Locale to Slovakia.

Operator View Parent Theme and Operator View Theme under Pos Terminal > user Interface > Branding / Style tab should be set according to the enactor.xml theme configs.

Menu Group and default menu group under the user interface > general tab should be set according to the original menu group.

| Field Description | Value | Comment |

|---|---|---|

| Fiscalisation Type | Slovakia | General Tab, select from dropdown menu. |

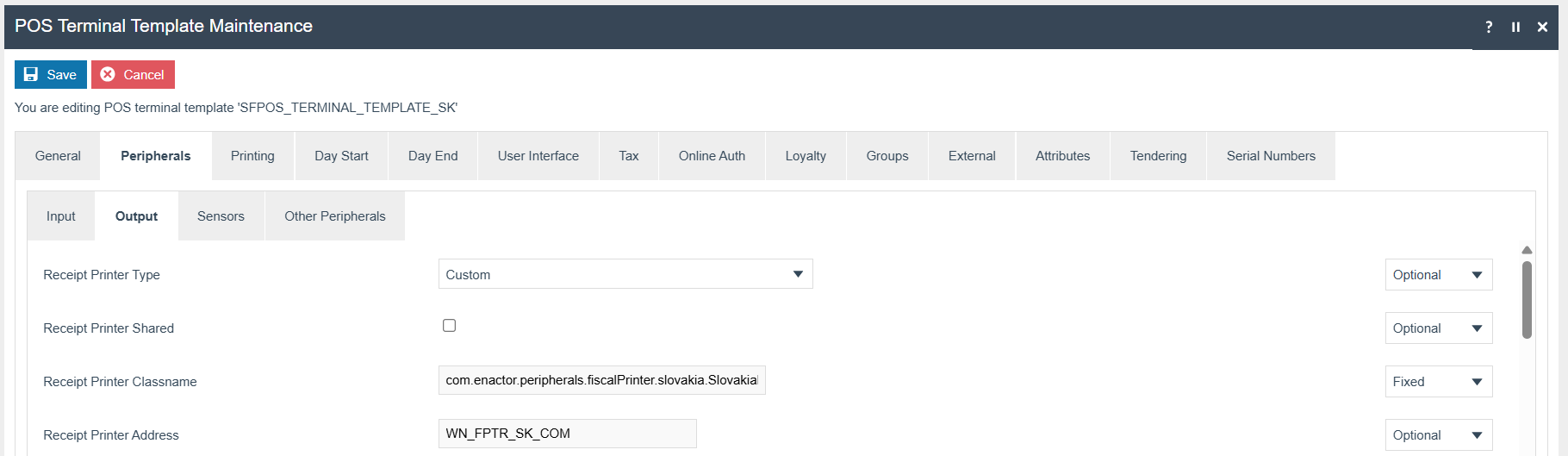

| Receipt Printer Type | Custom | Peripherals Tab - Output sub-tab, select from dropdown menu. |

| Receipt Printer Classname | com.enactor.peripherals.fiscalPrinter.slovakia.SlovakiaFiscalPrinter | Peripherals Tab - Output sub-tab, add to the text area in front of the Receipt Printer Classname |

| Receipt Printer Address | WN_FPTR_SK_COM | Peripherals Tab - Output sub-tab, add to the text area in front of the Receipt Printer Address |

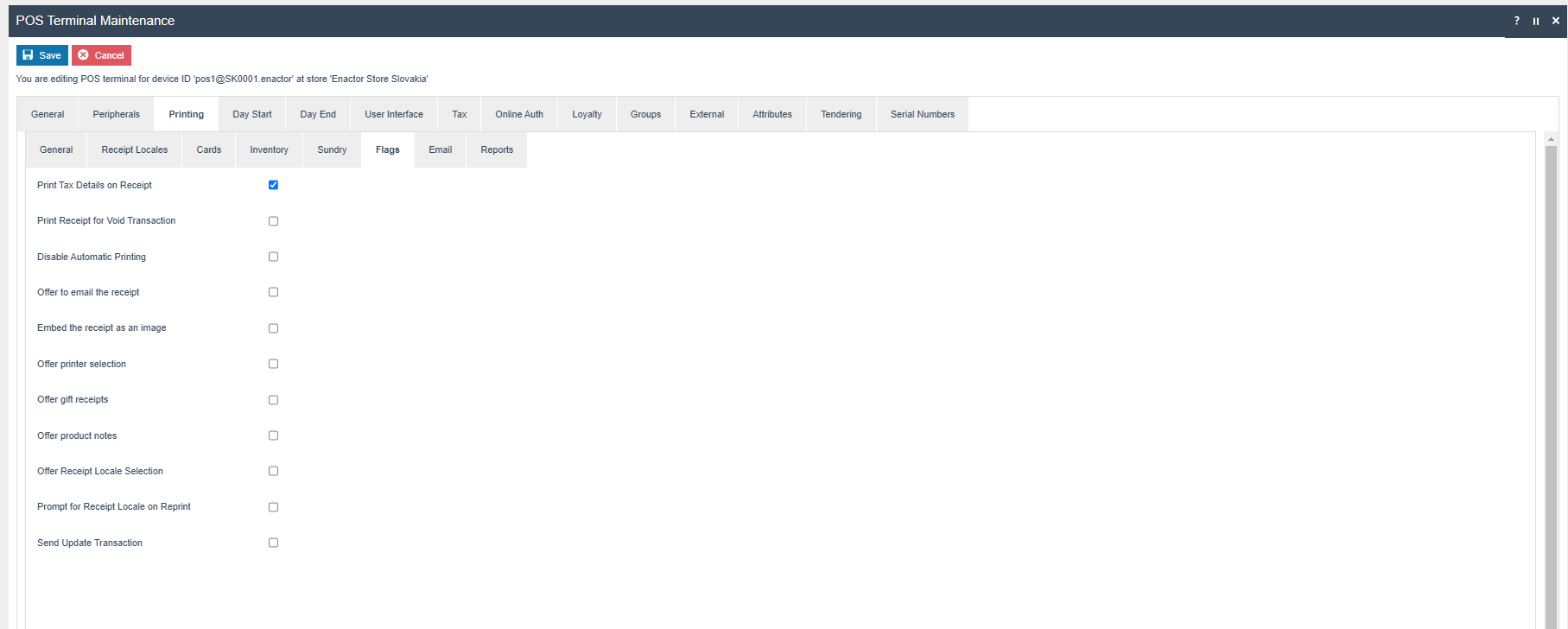

| Print Tax Details on Receipt | true | Printing Tab - Flags Tab, select from dropdown menu. |

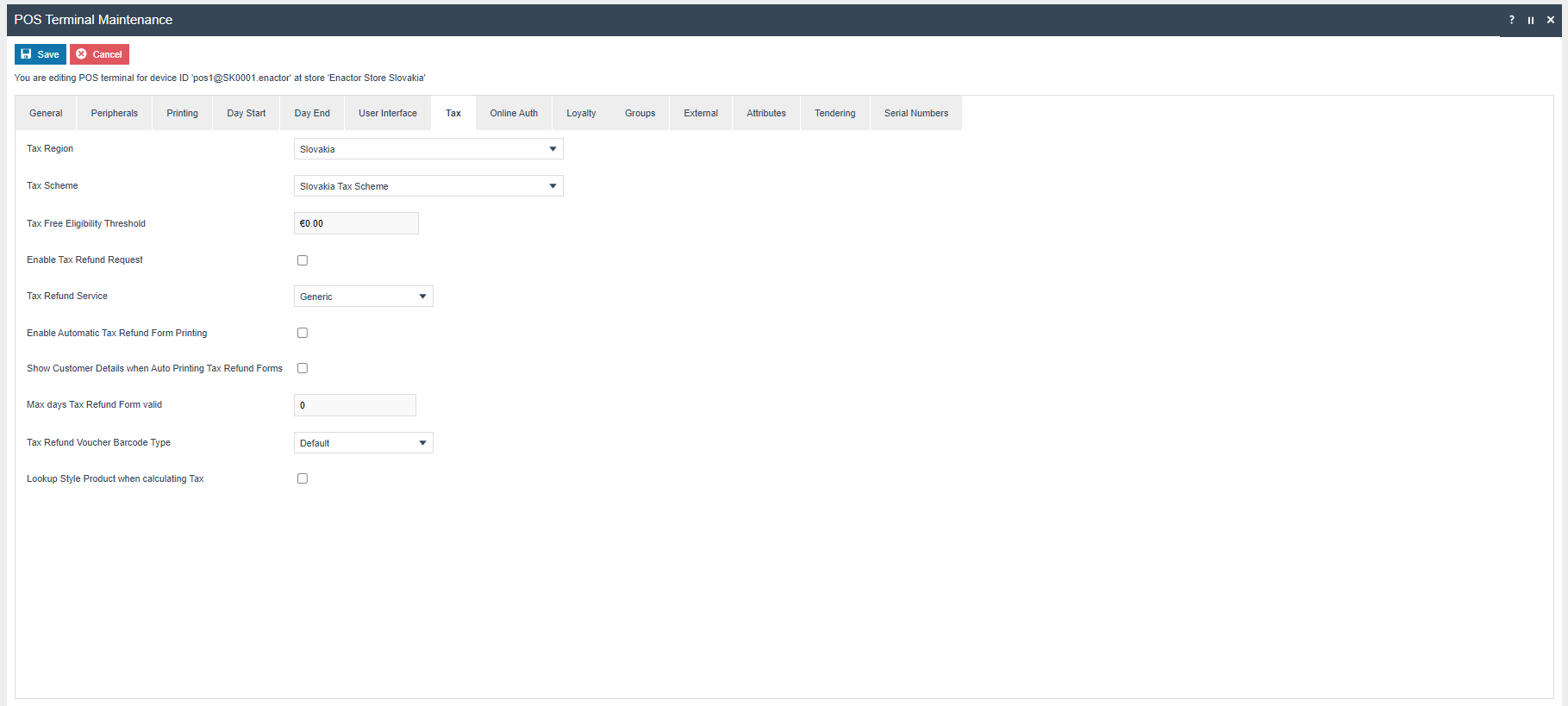

| Tax Region | Slovakia | Tax Tab, select from dropdown menu. |

| Tax Schema | Slovakia Tax Scheme | Tax Tab, select from dropdown menu. |

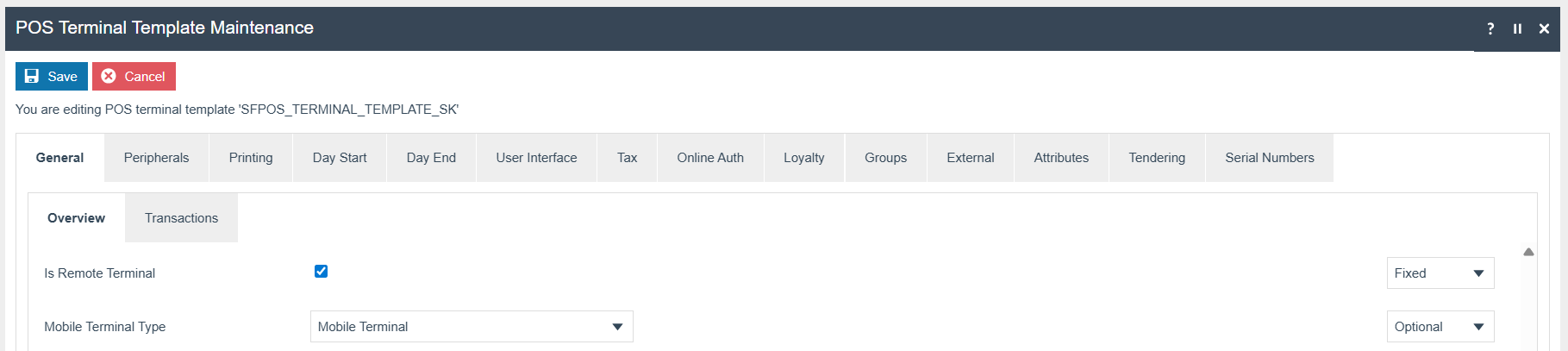

Check Is Remote Terminal

Select Mobile Terminal from the drop down

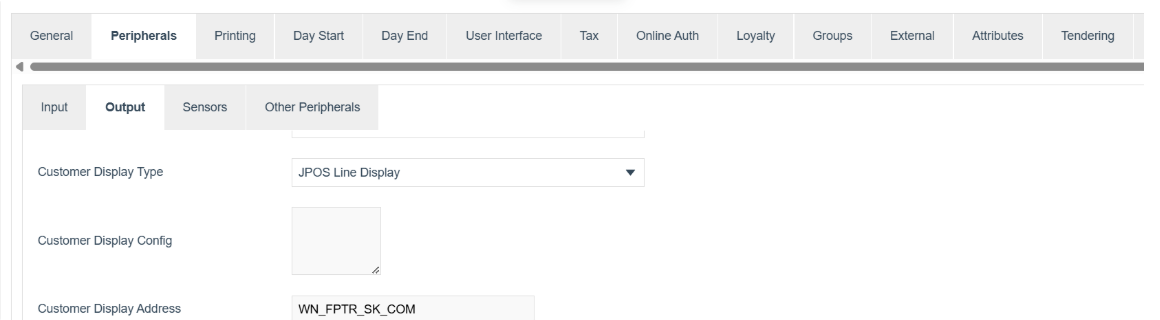

Line Display Configuration Parameters

-

Navigate to POS Terminal Template Maintenance

-

Edit the relevant POS Terminal Template

-

Navigate to Peripherals → Output

-

Add the following configurations

Select JPOS Line Display as the Customer Display Type

Add the Customer Display Config as WN_FPTR_SK_COM

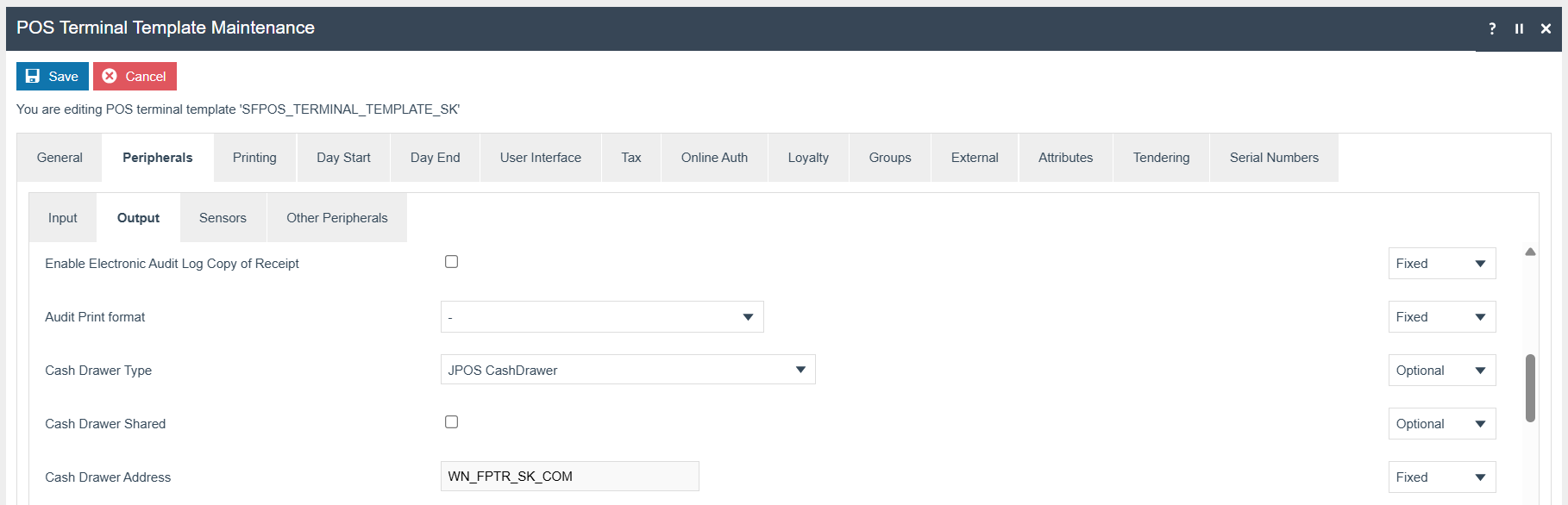

Cash Drawer Configuration Parameters

-

Navigate to POS Terminal Template Maintenance

-

Edit the relevant POS Terminal Template

-

Navigate to Peripherals → Output

-

Add the following configurations

Select JPOS CashDrawer as the Cash Drawer Type

Add the Cash Drawer Address Config as WN_FPTR_SK_COM

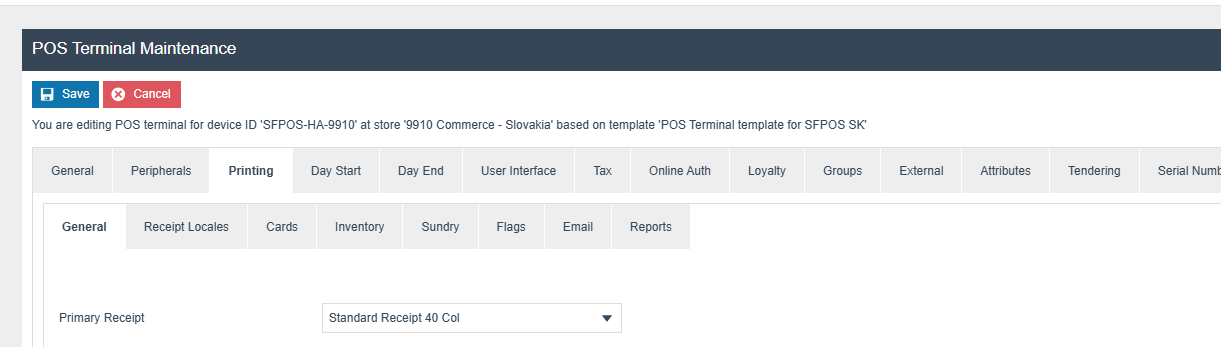

The primary Receipt should be set to Standard Receipt 40 Col.

The ‘Print Tax Details on Receipt’ flag within the printing > flags tab should be ticked.

Within the Tax section the Tax region should be set to Slovakia and the tax scheme to the Slovakia tax scheme configured in the previous section.

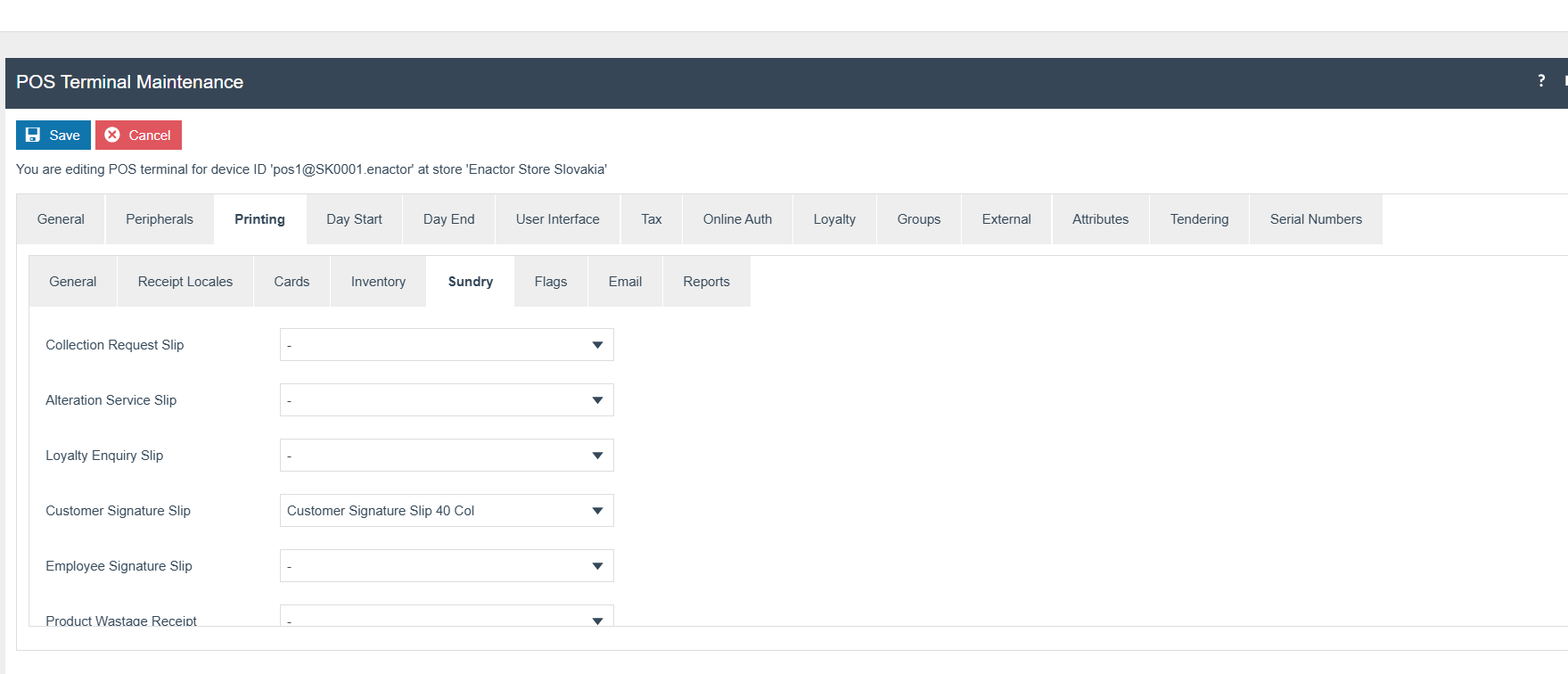

Customer Signature slips

In the pos terminal we have to select Customer Signature Slip 40 col as the signature slip template.

Pos terminal Maintenance → Printing tab → Sundry Tab → Set Customer Signature Slip 40 col for the Customer Signature Slip location.

POS Terminal

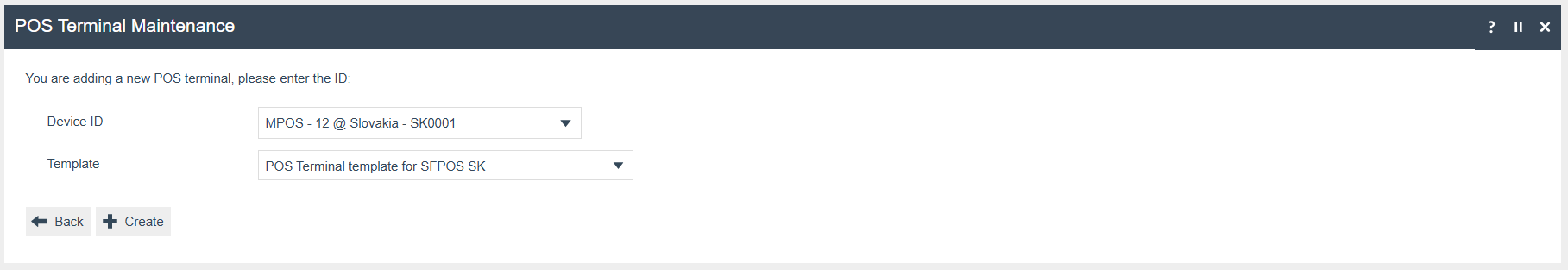

Create a POS Terminal for the Device type Mobile Pos

Select the Device ID created for the Mobile POS

Select the POS Terminal Template

Tenders

Configuration

FiscalTenderId will be set as the above legal requirement for Slovakia

| Tender Id | Description | Region | Currency | Fiscal Tender Type |

|---|---|---|---|---|

| CASH | Cash SK | Slovakia | Euros | CASH |

| CARD | Cards SK | Slovakia | Euros | CARD |

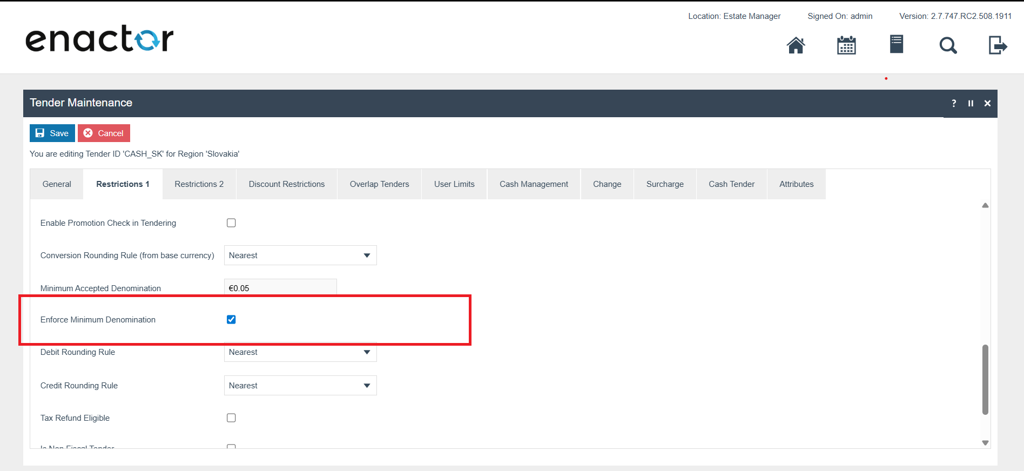

To enforce this denomination restriction, enable the following configuration:

Path: Tender Maintenance → Restrictions 1 Tab

set the following values.

Minimum Accepted Denomination = 0.05

Setting: Tick "Enforce Minimum Denomination"

This configuration will prevent cashiers from entering tender amounts that don't comply with Slovakia's 5-cent minimum denomination requirement, ensuring all tender values end in either 0 or 5 cents only.

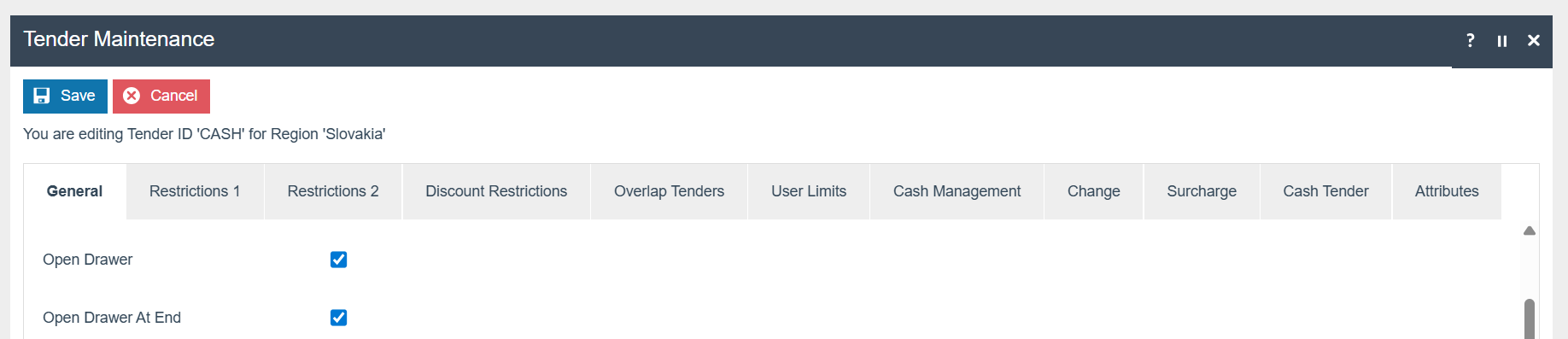

Check Open Drawer and Open Drawer At End for the tender that needs to open the cash drawer

Privileges

The following privileges will need to be configured against the appropriate roles and broadcast to the Slovakia devices. Consideration should be given to whether it is desirable for all operators to have all of these privileges or if some should only be granted to managers. For more detail on Privileges and roles refer to the How-To Guide Configuring User, User Roles and User Templates

| Privilege ID | Application Package |

|---|---|

| enactor.pos.AllowReturnTaxRefundItemAlreadyRedeemed | Enactor POS |

| enactor.pos.AuthorisesReturnItem | Enactor POS |

| enactor.pos.ReturnItemAllowed | Enactor POS |

| enactor.pos.PrintFiscalReports | Enactor POS |

| enactor.pos.VoidTransactionDiscountAllowed | Enactor POS |

| enactor.admin.Run | Enactor POS |

| enactor.pos.ReprintRecentReturnToTransaction | Enactor POS |

| enactor.pos.VoucherRedeemAllowed | Enactor POS |

| enactor.pos.ReturnFromReceiptAllowed | Enactor POS |

| enactor.pos.AuthorisesVoidCardTenderItem | Enactor POS |

| enactor.pos.AuthoriseDayEndBeforeEarliest | Enactor POS |

| enactor.pos.AuthorisesVoidTenderItem | Enactor POS |

| enactor.pos.CashRefundAllowed | Enactor POS |

| enactor.dayStart.AuthorisesDayStart | Enactor POS |

| enactor.pos.ContinueWithDrawerOpen | Enactor POS |

| enactor.pos.AllowEmployeeReturnIfUserInvolved | Enactor POS |

| enactor.pos.AllowUnknownProductSale | Enactor POS |

Products

Set the Tax group and Price for each product (Currency : EUR)

For more detail on product creation refer to the How-To Guide Configuring a Merchandise Product and How-To Guide Configuring Product Prices

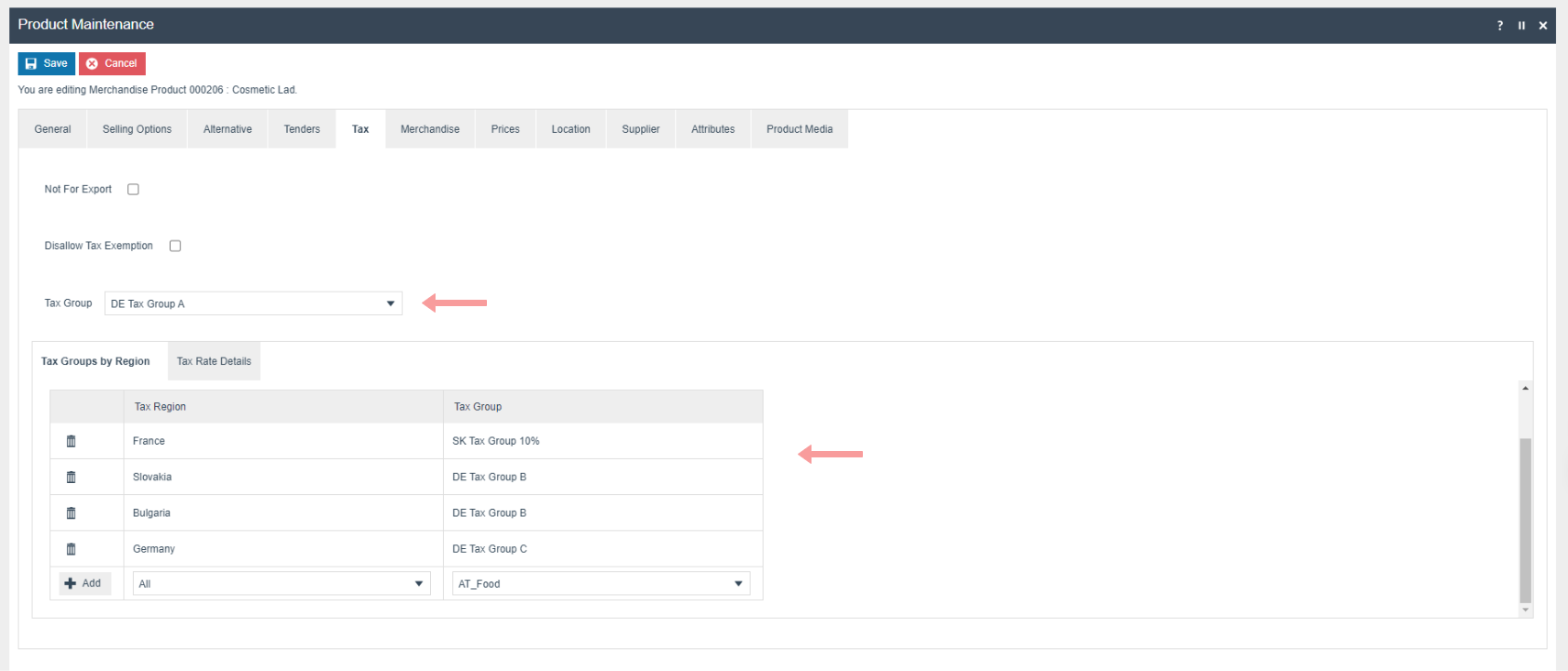

Product Tax

The following tax configurations should be configured againts the products and broadcast to the appropriate Slovakia devices.Tax group can be defined to either configure the tax group or have a tax group by tax region.

Menu

On the EM navigate to Configuration > System > Menu

-

Edit the “SALE” menu for the Menu Group “Standard POS”

-

Add a folder under “Sales > Management > Report” called “Fiscal

Reports”

-

Add new buttons to the Fiscal Reports Folder for the following:

| Event | ID | Button Label | Name | Java Type | Value |

|---|---|---|---|---|---|

| Fiscal_PrintReports_X | Fiscal_PrintReports_X | Fiscal X Report | ReportType | String | X |

| Fiscal_PrintReports_Z | Fiscal_PrintReports_Z | Fiscal Z Report | ReportType | String | Z |

For more detail on menu creation refer to the How-to Guide Configure POS Behaviour (Menus)

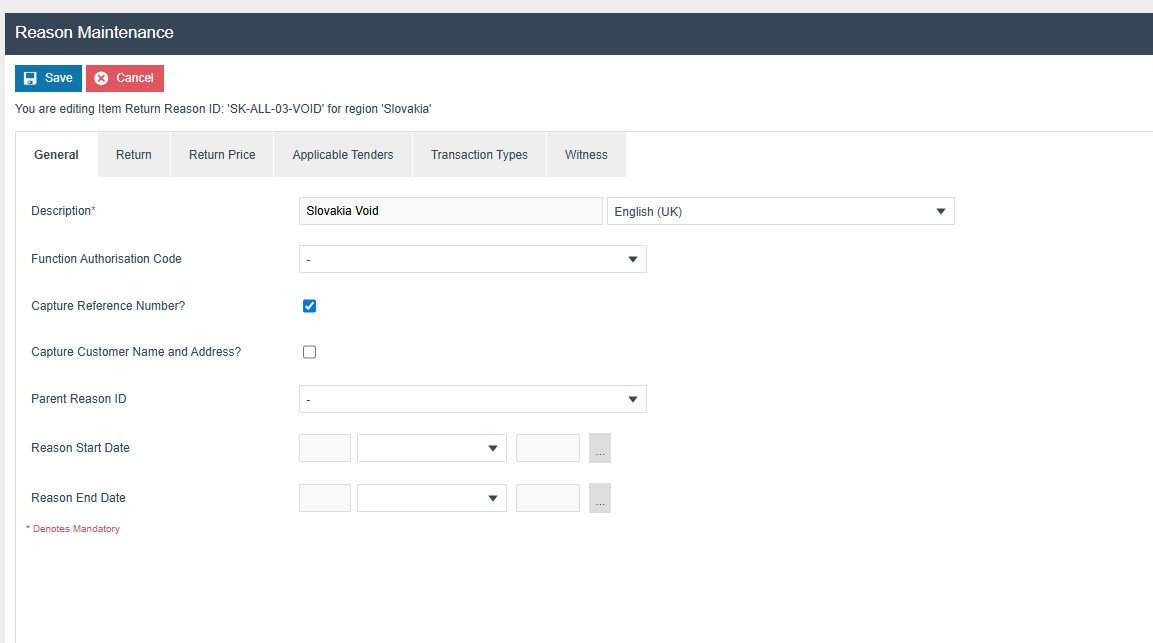

Reason

For “item return” type reasons, the "Capture Reference Number" option must be ticked in the particular reason configuration.

Translations

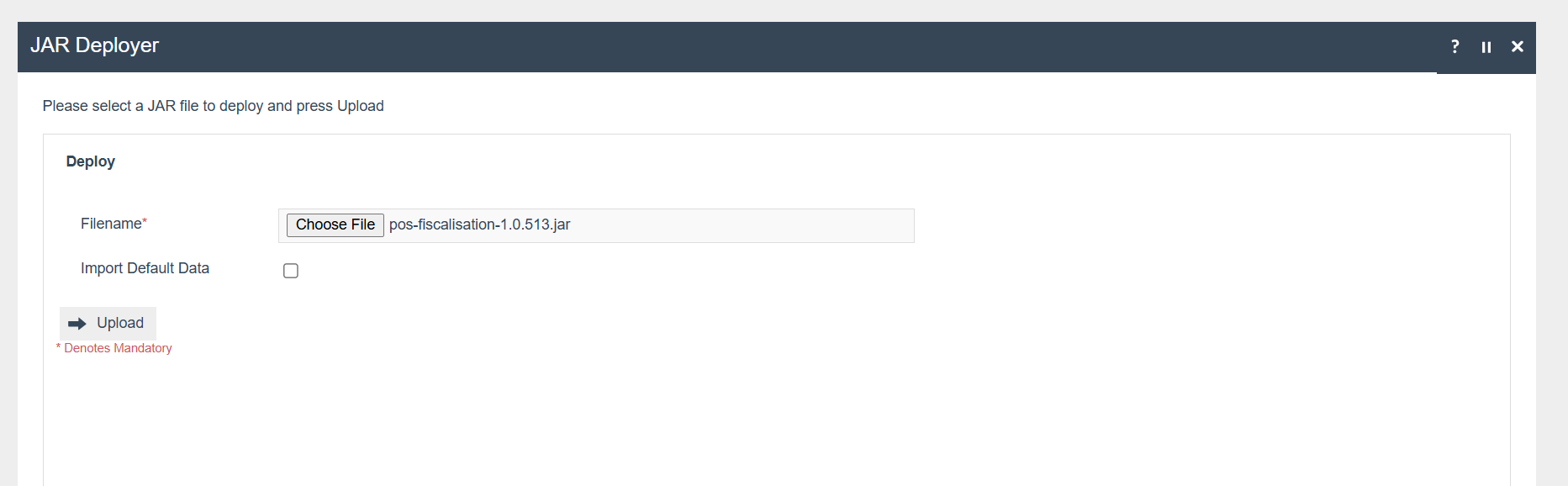

Deploy the pos-fiscalisation JAR using the JAR Deployer

If the user locale is set to English, the Enactor POS will be displayed in English. If you need to modify any default text in the Enactor POS, navigate to Application Translation, select the Application Package as POS Fiscalisation and select the user locale, which is English (UK). Then, you can edit the relevant message file by clicking the '+' button. Then broadcast the Message Resource entity.